Preliminary North American Class 8 orders jumped in November, outpacing historical averages as fleets get in equipment orders before the year’s end, according to research firms that track the commercial vehicle market.

“Even though backlogs—in seasonal fashion—are rising, they continue to point to a different market vibe heading into 2024: Still good, for sure, but solid, rather than stellar,” said Kenny Vieth, ACT Research president and senior analyst.

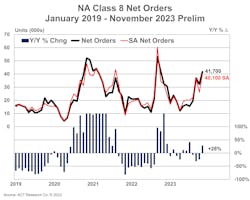

Net orders of 41,700 Class 8 vehicles last month were up 9,000 (28%) from October and 9,000 year-over-year figures, according to ACT Research. A more modest 36,750 net units were ordered in November, according to FTR Transportation Intelligence, whose figures were 32% higher than in October and up 2% year-over-year.

FTR reported the upticks fell within expectations, given seasonal tendencies and the considerable year-over-year order decreases in October. Total Class 8 orders for the previous 12 months are at 255,500 units, according to FTR’s tracking.

Build slots continue to be filled at a healthy rate, according to FTR. The firm noted that the slight yearly November order increase shows a market still performing at a high level historically.

“We also saw a more cohesive market for OEMs versus October, with the majority seeing increases in orders,” Eric Stark, FTR chairman, said Dec. 4. “Despite prolonged weakness in the overall freight market, fleets continue to be willing to order new equipment. Order levels were above the historical average but continue to follow seasonal trends, stabilizing our expectations for replacement demand in 2024.”

ACT’s November figures represent the highest monthly net-order intake since October 2022, according to Vieth.

“A modest seasonal factor presses down gently this month, with seasonal adjustment dropping November’s [seasonally adjusted] intake to 40,100 units, making November the best ‘real’ order month since September 2022,” Vieth said Dec. 4. “Since the filling of 2024’s orderboards began in earnest in September, Class 8 orders have been booked at a 413,000” seasonally adjusted annual rate.

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.