FMCSA seeking information on fairness of leasing agreements

The federal government is taking a closer look at the fairness of truck leasing agreements as the Federal Motor Carrier Safety Administration issued a request for information on drivers’ leasing agreements for commercial motor vehicles.

About the Truck Leasing Task Force

TLTF is a federal advisory committee established through Congress as part of the Infrastructure Investment and Jobs Act.

FMCSA announced that it was seeking TLTF applicants in April 2022. FMCSA then announced the Task Force’s nine members in May 2023. Since then, TLTF has held three virtual meetings to examine proposed leasing issues and risks.

In its latest meeting on Jan. 18, the Task Force identified questions it would like to ask commercial motor vehicle drivers about their positive and negative vehicle leasing experiences. These questions would be included in the RFI in the Federal Register.

The agency’s Truck Leasing Task Force seeks information to help identify terms or conditions that may be unfair to drivers. The RFI notice appeared in the Federal Register on Feb. 15. Public comments are open through March 18.

“Truck leasing is an environment that allows an independent contractor the opportunity to purchase equipment and get their business going,” David Heller, SVP of safety and government affairs for the Truckload Carriers Association, told FleetOwner. “It’s kind of like an agreement between the lessor and the lessee that allows them the opportunity to get new equipment and use it for how they operate their own business.”

State of U.S. trucking equipment leasing

Equipment leasing is an essential part of the trucking industry.

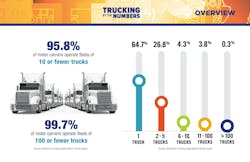

Trucking in the U.S. is dominated by small businesses. According to FleetOwner’s Trucking By the Numbers 2023, 95.8% of motor carriers operate fleets of 10 or fewer trucks.

These actors have limited capital for cash payments, so their best options for acquiring equipment are often through loans or leasing.

Both lending and leasing require regular payments to cover the cost of the equipment. Under a loan or other financing arrangement, the business usually owns the equipment title. Under a leasing agreement, the business can use the equipment, but the leaseholder still owns the title.

The good in leasing

Loans often have higher requirements that a small business might not be able to meet: strong credit score, proof of a business’s health, years of experience in the industry, and down payment around 20% to 30% of the equipment cost. Lease requirements vary widely, but many arrangements don’t have such high requirements as loans.

Leasing can also be an effective way for fleets to manage rising costs and can allow fleets to gain more control over their operations.

The bad in leasing

However, leasing also has a poor reputation among many in trucking.

When a lease agreement gives the leaseholder control over where and how the lessee can operate equipment, a power imbalance comes into play. The leaseholder can demand drastic payments and can limit the lessee’s ability to operate their business.

“Our experience in reviewing lease purchase contracts and receiving numerous complaints over the years tells us these programs almost never benefit anyone except motor carriers and should be avoided,” Norita Taylor, director of public relations of the Owner-Operator Independent Drivers Association, told FleetOwner on behalf of OOIDA. “These programs have traditionally been used as another revenue stream for the carrier with little regard for the owner-operator out there trying to live their American dream.”

OOIDA receives complaints from owner-operators about lease agreements. Some leaseholders won’t allow the owner-operator to operate or service the truck appropriately, limiting the operator’s ability to meet lease payments and succeed financially.

See also: 8 things to consider when choosing a leasing partner in 2024

More on the request for information

The Task Force is examining truck leasing arrangements’ terms, conditions, and equitability, particularly as they affect owner-operators and trucking businesses.

At the end of its examinations, TLTF will submit a report to the Secretary of Transportation, the Secretary of Labor, and Congress, identifying issues and recommending best practices for truck leasing arrangements.

The RFI asks for the leasing knowledge and experiences of lessees, leaseholders, trucker and advocacy organizations, attorneys, academics, and government officials.

The request includes example questions for lessees, such as: “How was the lease-purchase agreement marketed to you?” and questions for leaseholders, like: “What best practices do or did you implement or recommend to ensure that all leases of CMVs you provide are fair and just?”

What will the Task Force recommend?

The poor reputation of lease agreements is part of the motivation behind FMCSA’s Truck Leasing Task Force.

OOIDA believes the Task Force will take a more antagonistic approach to current leasing practices.

“It’s clear that the committee does not support this business model and will propose regulations that either make it more difficult for carriers to continue using or made illegal altogether,” Taylor said.

See also: Equipment leasing and rentals take new turns in 2023

Heller does not know what the Task Force’s final recommendations might be, but he hopes that they highlight the best practices of good leasing agreements.

“The reason the agency’s going down this path is certainly there are bad apples in the industry, but we have to acknowledge that there are very good apples in the industry too, which is one thing seemingly that never gets acknowledged,” Heller said.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.