January prelim truck orders 'ugly' but not suprising

Preliminary reports show North American Class 8 truck production took an expected tumble in January, going against a softening economy and some very tough to match results from a year ago.

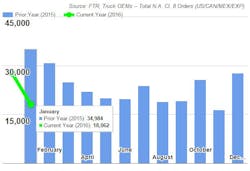

At 18,200 units in January, Class 8 net orders were down 48% against a strong January 2015, according to ACT Research. Additionally, January volume was off 35% versus a better than expected December. January’s orders are the second lowest intake since mid-2012.

“Economic reports over the course of January were broadly disappointing, with industrial-related data points particularly soft,” said Kenny Vieth, ACT’s President and Senior Analyst. “Ongoing weakness in the freight intensive manufacturing sector continued to weigh on capacity utilization following a year in which Class 8 tractor retail sales fell just short of an all-time record. As a result of the soft supply-demand environment, the lackluster Class 8 order trend that started in late 2015 continued into 2016.”

The slow but steady trend that has been in evidence for the past several years continued with January’s medium-duty orders, ACT reported. While down 19% from December’s above-trend order volume, January’s Classes 5-7 net orders rose nearly 3% compared to a year-ago to 18,200 units.

On a seasonally adjusted basis, however, ACT puts the decline at only 10% from December and almost exactly in-line with the 12-month order average of 19,300 units/month, Vieth added.

FTR’s preliminary data shows January Class 8 truck net orders slipping back to 18,062 units, and the research firm pointed out that net Class 8 orders for five of the last eight months were below 20,000 with a monthly average for the period of 21,200 units. Since September, order activity has been “unusually volatile” with the minimum monthly swing more than 6,500 units. January Class 8 order annualized to 217,000 units, FTR calculates.

“Orders in 2014 equaled a strong 376,000, 2015 was down from that to just 284,000 orders and now 2016 is starting off even weaker. It is not looking to be a strong year,” says FTR Chief Operating Officer Jonathan Starks. “However, the fundamentals for freight and demand for truck services should hold up well enough to keep the market at replacement levels. In order to see that occur we would expect to see orders improve as we get into the spring months and fleets finalize their plans for 2016 expenditures.”

Stifel transportation equipment analyst Michael J. Baudendistel, in a note to investors, said the Class 8 total was “relatively in line” with expectations given the weak economic backdrop, the oversold conditions following a very strong 2015, and the direction of orders in recent months—exclusive of the better-than-expected December total.

“So, while orders may appear ugly against tough comps, the number did not surprise us,” Baudendistel writes.

Similarly, the Sitfel report noted that medium duty demand was “relatively stable” and in line with expectations.

“We continue to believe medium duty production will be flat to down slightly in 2016, and will grow more or less in line with GDP in the few years that follow,” Baudendistel says.