ELFA: Trucking represents 7.3% of new business volume

New business volume grew 12.4% in the equipment finance industry in 2015, according to the 2016 Survey of Equipment Finance Activity (SEFA) released by the Equipment Leasing and Finance Association (ELFA). The rise in new business volume marked the sixth consecutive year that businesses increased their spending on capital equipment, according to the report. The SEFA report covers statistical, financial and operations information for the $1 trillion equipment finance industry, based on a survey of 116 ELFA member companies.

As an end-user of equipment finance, the trucking industry represented 7.3% of new business volume reported by ELFA member companies, up from 6.4% in 2014. Trucks/trailers represented 13.4% of equipment financing new business volume reported by ELFA member companies, up from 12.8% in 2014.

“The equipment finance industry saw positive growth overall in 2015, as reported in the 2016 Survey of Equipment Finance Activity,” said ELFA president and CEO Ralph Petta. “More recent data collected in the first two quarters of 2016 suggests the equipment finance industry is entering a period of slower growth as business confidence and global markets appear increasingly volatile. We are pleased to make this data available to provide comprehensive performance metrics for equipment leasing and finance companies.”

Key findings for 2015 as reported in the 2016 SEFA include:

• Overall new business volume grew 12.4%. By organization type: Independents saw a 59.9% increase in new business volume, while banks saw an 11.6% increase and captives saw a 3.3% increase. By market segment: New business volume grew 2.8% in the small-ticket segment, while middle-ticket grew 12.4% and large-ticket climbed 33.9%.

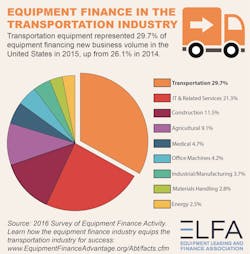

• From an asset perspective, the top-five most-financed equipment types were transportation, IT and related technology services, construction, agricultural and medical equipment. The top five end-user industries representing the largest share of new business volume were services, industrial and manufacturing, agriculture, transportation and wholesale/retail.

• Cost of funds climbed 17 basis points, due at least in part to the increase in the Federal Reserve discount rate in late 2015. This was the Fed’s first increase since 2007, and it translated into increased downward pressure on pre-tax spreads.

• Assets under management climbed 10% in 2015, while return on assets declined slightly to 1.5%.

• Net income increased 1.2%. Return on average equity decreased slightly but remained strong at 16.1%.

• Overall, delinquencies remained steady, with less than 2% of receivables over 31 days past due. Net full-year losses or charge offs increased slightly but remained at 0.2% of average receivables.

• Credit approvals decreased slightly while the percentage of approved applications that were booked and funded edged up.

• Employment levels grew moderately by 6.8%, with headcount in sales and marketing functions increasing at a similar level. There was a significant increase in headcount associated with compliance.

PricewaterhouseCoopers LLP administered the 2016 SEFA. The results were compiled from surveys sent to 375 eligible ELFA member companies in the first quarter of 2016. A total of 116 companies submitted 2015 U.S. domestic lease and loan data.