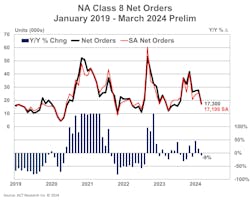

Orders for Class 8 units have dropped significantly in the last month, according to preliminary reports from FTR Transportation Intelligence and ACT Research.

Both firms’ preliminary findings noted that March’s net Class 8 orders were down compared to February and March 2023.

“Despite weakness in the freight markets that has persisted for more than a year, fleets continue to be willing to order new equipment,” Eric Starks, chairman at FTR, said. “Order levels in March were below the historical average but remained in line with seasonal trends. Demand is not declining rapidly, but neither is the market doing significantly better than replacement level demand.”

March’s Class 8 unit orders dropped

FTR’s preliminary data counted 18,200 net orders for Class 8 units, down 34% from February and down 4% year over year. Meanwhile, ACT’s preliminary data found 17,300 orders, down roughly 50% from February and down 8.7% year over year.

According to Steve Tam, VP and analyst for ACT, March’s Class 8 order activity was capped by “nascent improvements in the freight market and select OEMs’ efforts to smooth demand, notwithstanding forced conservatism among a portion of the truck-buying populace.”

Tam noted that waning demand for tractors seemed to retrench in March.

Though the decline in orders from February were significant, FTR noted that March’s activity fit seasonal expectations. Orders were still comparable to March 2023’s and had slowed at a typical rate for the season.

About the data

FTR and ACT both release monthly data on Class 8 orders. The firms release preliminary data near the end of a given month, with final counts available a few weeks later.

Final Class 8 order data from FTR and ACT for March will be available in mid-April.

Return to seasonal lows

The beginning months of 2024 faced significant Class 8 order activity. March’s order numbers were the lowest of several past months.

According to ACT’s data, March was the first month with seasonally adjusted activity below 20,000 units since May 2023. For FTR, it is the first month with below 20,000 units since August 2023. FTR noted that, before March, the last three months maintained an average order level of about 27,000 units.

According to both firms’ data, Class 8 order activity rose sharply from the second half of 2023 into the first months of 2024. With March’s preliminary data, order activity seems to have dropped back to mid-2023 levels.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.