Truck manufacturers, dealers, and suppliers are gearing up for the 2027 prebuy. Fleets should begin doing the same, as new regulations will greatly impact fleet operations.

According to Environmental Protection Agency heavy-duty vehicle regulations finalized in 2022, model year 2027 heavy-duty trucks must emit no more than 0.035 grams of NOx per horsepower hour. To achieve this and other regulations, analysts anticipate the cost to purchase and maintain that equipment could soar by $20,000 to $30,000.

To avoid paying the higher price of 2027 trucks, industry analysts and participants predict fleets and prospective heavy-duty truck owners will attempt to buy enough 2025 and 2026 trucks to meet their equipment requirements for 2027 and beyond. This expected behavior is what’s become known as the “2027 prebuy.”

To help make sense of the prebuy, an OEM supplier consultant and a general manager at a dealership break down the differences between current trucks and those to come in 2027. They also outline the best strategy fleets can implement to ensure they receive the trucks they need on time and ahead of the new regulation—get in line early.

See also: 2027 prebuy strategies: How fleets can prepare before regs kick in

Vehicle changes due to EPA’s 2027 regulation

Even with the upcoming change in presidential administration, the shift to cleaner trucking is well underway. While the EPA GHG Phase 3 regulation is likely to be changed or slowed, the Trump administration has given much less attention to the EPA's MY 2027 NOx regulation. Further, truck and engine manufacturers have already made significant changes to their powertrains to ensure 2027 regulation compliance.

EPA’s regulation adds “more complex, more strict emissions standards,” Diego Depetris, partner at consulting firm Bain and Company, said during a recent industry conference. These regulations will require heavy-duty trucks of 2027 and beyond to feature redesigned engines and more robust aftertreatment systems.

Post-2027 engine changes

Several OEMs and engine manufacturers have already made changes to their engines to accommodate the EPA’s emissions standards for MY2027 trucks, which FleetOwner has outlined.

Mack Trucks’ MP8 engine features a piston redesign that provides a 90% soot reduction and 2% fuel economy improvement. Paccar MX engines now feature reduced weight and features to improve engine component longevity and combustion.

Detroit added insulation in its DD13 Gen5 engine to keep it running hot during idle, helping the aftertreatment system function properly, Len Copeland, product marketing manager for Detroit Diesel, told FleetOwner in March. The new Cummins X15 engine is designed to comply with EPA’s 2027 emissions regulations. It features a larger aftertreatment system, piston friction reductions, and weight reduction.

Maintenance changes

On the maintenance side, the EPA 2027 regulation requires OEMs to implement “longer regulatory useful life and emission-related warranty requirements to ensure the final emissions standards will be met through more of the operational life of heavy-duty vehicles.”

This will generate even more costs for the manufacturer, which Depetris believes will also be passed on to the consumer, contributing to the higher price of 2027 model trucks.

Further, while we’re still a ways off from implementing powertrains that are fully compliant with EPA’s 2027 emissions regulations, current trends point to a heavier use of aftertreatment systems to meet those targets.

Aftertreatment systems already cause headaches for fleets, and an increased reliance on these systems—or with OEMs implementing more robust systems—could create even larger headaches and more downtime if those problems aren’t resolved.

Not only are current engines and aftertreatment systems a headache for fleets, but they’re also a headache for the dealerships that sell them, according to Jim Xintaris, general manager for Reefer Peterbilt, a dealership in Michigan.

“Our techs that are coming on board—the newer and younger generation—tell us that they want to work on engines, and ... they want to take the whole thing apart; they want to see how the parts inside work,” Xintaris said. “And really, what they become are diagnosticians.”

These new engines have also been the cause of retention problems among technicians.

“We’ve even had techs leave because they got tired of just pulling wires,” he said.

The industry can only expect even more maintenance complications in MY 2027 trucks, providing another reason for fleets to participate in the 2027 prebuy.

See also: Navigating the CARB prebuy for truck procurement: What fleets need to know

Get in line to prebuy while there’s still time

Xintaris and Depetris both compared the upcoming 2027 prebuy to the 2007 prebuy, when EPA rules regulated emissions standards on heavy-duty trucks in phases from MY 2007 to 2010. Fleets that waited too late to order trucks in 2006 “got shut off for a long time,” Xintaris said. To prevent that from happening this time, Xintaris and his team are encouraging customers to “get in line.”

Though not taking deposits, Xintaris’ Reefer Peterbilt is working to get potential pre-buyers on a list by the second half of 2025. That’s when Xintaris said the dealership will begin firming up orders and builds.

He’s telling customers, “If you’re not in line, we’re not going to build you a truck."

Peterbilt has also encouraged Xintaris and his team to fill out their order books and map out truck builds over the next year.

“They've been much more intense about that than in the past,” he said. “They want to know what we're selling next September from today.”

One thing Xintaris stressed fleet owners should not do is wait until the last minute.

“It's that irrational customer that waits until the last minute and says, ‘I've been a loyal customer for 30 years, I can't believe you’re doing this to me, I want my 25 trucks next month,’ and then they get shuffled in line,” Xintaris explained. “That's the dealer's conundrum: How much cushion do we build for those people because we know that they're out there.”

The fleet landscape of 2027 and beyond

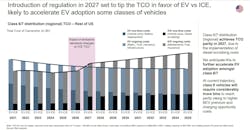

Purchasing a Class 8 diesel tractor during the 2027 prebuy could be the last time that purchasing a diesel-powered truck is the most feasible option. Depetris and his team predict the total cost of ownership for a Class 8 tractor will be higher than a comparable alt-fuel vehicle or electric Class 8 vehicle as soon as 2027 emissions rules go into effect.

“Battery electric vehicle costs are coming down,” he explained. “Regulatory mandates, incentives are things bringing down that cost of the electric vehicles over time; while similarly, you're seeing the comparable diesel vehicle total cost of ownership going up.”

The increased cost of the diesel trucks for model year 2027 and beyond will “accelerate the transition to electric vehicles,” Depetris predicts.

See also: Two fleets weigh in on their EV transition progress

The EPA’s rule for MY 2027 heavy-duty vehicles won’t be the last of diesel-powered trucks, but it will signal the beginning of a completely different trucking landscape for fleet operations.

About the Author

Jade Brasher

Senior Editor Jade Brasher has covered vocational trucking and fleets since 2018. A graduate of The University of Alabama with a degree in journalism, Jade enjoys telling stories about the people behind the wheel and the intricate processes of the ever-evolving trucking industry.