September's Class 8 truck orders down 44% YoY

Key takeaways

- The preliminary count of Class 8 orders in September declined 44% YoY, indicating a significant slowdown in industry demand.

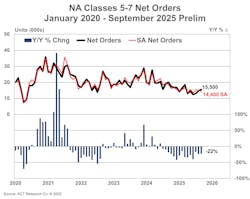

- Medium-duty Classes 5-7 orders fell 22% YoY.

- Industry faces ongoing regulatory uncertainties and a long-standing downturn.

ACT Research’s preliminary September count of North America Class 8 net orders was 20.8k units, a 44% year-over-year decline. The firm will publish its complete industry data for September, including final order numbers, in mid-October.

“On a seasonally adjusted basis, Class 8 orders totaled 18,800 units, a 225k SAAR [seasonally adjusted annual rate]. On a 6- and 12-month basis, orders continue to trend down, at 178k and 235k, respectively,” Carter Vieth, research analyst at ACT Research, said. “The longest for-hire downturn in history continues to weigh on tractor demand as freight rates continue to run below inflation levels. And even as more tariffs are imposed, the nation awaits a verdict on IEEPA tariffs in a case the Supreme Court will hear in early November. On top of tariffs, the industry awaits the announcement from the EPA on the future of low-NOx regulation. Quite the Q3 for the industry and a challenging start to the opening of 2026 order boards.”

Regarding medium duty, he added, “Preliminary September NA Classes 5-7 orders fell 22% YoY to 15,500 units. Increased consumer pessimism, slowing services growth, and economic uncertainty continue to weigh on Classes 5-7 orders. On a seasonally adjusted basis, Classes 5-7 orders decreased 2.9% m/m to 14,400 units, a 173k SAAR. On a 6- and 12-month basis, orders continue to trend lower, at 174k and 182k, respectively.”