In May, the Shell Starship 2.0 took off from San Diego on its way to Jacksonville, Florida, in the hopes of continuing the focus of fuel efficiency within the trucking industry.

That is likely as the truck equipped with the latest in aerodynamics, regenerative braking, and many more additions such as solar panels on the roof is something of a conversation starter. The white Class 8 truck streaked with yellow and red has the contours of a bullet train and refuses to waste energy on anything but the task of moving freight. To that end, Starship 2.0, the follow-up to the original 2018 Starship project, is shaping up to be a bellwether for fleets everywhere that want to shed fuel costs and emissions.

Reducing both are critical to the success of trucking companies trying to remain profitable by staying ahead of rising fuel costs and stricter emissions regulations. And Shell believes the right complement of technology working together can help fleets reach these goals.

“Shell Starship 2.0 will feature technologies that have advanced since its inception and is built to stimulate discussion and drive the conversation around trucking efficiency and carbon reduction,” said Jeff Priborsky, global marketing manager for the on-highway fleet sector at Shell Lubricants. “We have taken a number of technologies and have drawn them together in a single design with a holistic, connected approach that is crafted to optimize performance and efficiency.”

A second run this August will test how the truck performs in hotter weather, with all the results expected to be released at the 2021 Advanced Clean Transportation (ACT) Expo in Long Beach, California.

The equipment and technology aboard Starship 2.0 may draw the most attention from fleets; though what’s keeping this truck a well-oiled efficiency machine, specifically the engine oil, should not be overlooked. Shell after all is an oil company, and the use of Shell Rotella T6 Ultra 5W-30, which is not commercially available, is expected to fuel further savings.

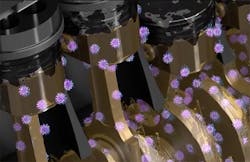

In this case, the lower viscosity lubricant reduces friction in the engine.

“The thinner the oil, the easier it is to flow, the less input energy it takes for parts to move against each other,” said Karin Haumann, OEM technical manager with Shell Global Solutions. “The increased fuel economy comes from that.”

But there is a lot more to these lubricants than that. A lower level of viscosity is a big facilitator in fuel efficiency, but it is not the only factor. Various additives allow the latest engine oils to use less energy, remove more sludge and soot, maintain the engine longer, and perform over longer intervals. Like on the Starship, these various components work in concert within the engine to provide benefits invisible to the eye, but that will be felt through lower fuel and operational costs.

The broader story in all of this is how the fuel sector, trucking OEMs, and fleets have worked together to make engine oil as efficient as possible to reduce fuel consumption and total cost of ownership. And more savings can be gained due to reduced wear and tear on the engine, keeping more trucks on the road and out of the shop.

The drive to efficiency

The first iteration of Starship bettered freight ton efficiency by 2.48 over the North American average of 72 ton-miles per gallon. In terms of general efficiency, Starship accrued an 8.94 mpg while the average at the time was 6.4 mpg. Starship 2.0 is hauling a 47,000-lb. payload, 18% higher than in 2018, and findings will be released later this year.

While there is never a wrong time to redouble efforts to maximize fuel efficiency, few moments are more opportune than 2021 to look at how heavy-duty trucks can get farther on less fuel. First off, it’s just good business sense, as fuel is the top vehicle-based marginal hourly cost. In 2019 it was $15.62, according to the American Transportation Research Institute. That’s more than double the next highest vehicle-based cost: truck and trailer payments.

Driver pay, the top cost overall, has also risen progressively since 2011 to $21.01 in 2019, an increase of 14%. The trucking boon of 2018 had driver wages at $23.50 per hour, and the driver shortage was exacerbated by the COVID-19 pandemic shutting down truck driver training schools and state departments of motor vehicles. So, cutting fuel costs will help mitigate any increases to this expenditure.

Finally, the price of diesel, just $2.64 per gallon in January, rose to $3.14 in May. That might increase even more due to a shortage of fuel truck drivers, many of whom switched jobs or retired in 2020. Hauling hazmat also requires an additional commercial driver’s license endorsement and security screening, which was not always available in 2020. Up to a quarter of U.S. tank trucks are not being utilized, according to the National Tank Truck Carriers.

And making the trucks more efficient with equipment, such as improved aerodynamics and engines, and pairing that equipment with technology such as adaptive cruise control, has helped diminish these costs.

Types of oil

There are several brands to choose from, but because of the complexities of engines, users must stay within a certain range of viscosity based on factors such as engine make and operating temperature. The Society of Automotive Engineers (SAE) developed its numerical system to designate what that viscosity is. The first number indicates viscosity, or the speed at which the fluid travels, at low temperatures, while the last number is at ambient temperature. So, a 10W is less viscous than a 15W and will flow easier, or more efficiently, through the engine.

With Starship 2.0, Shell will find out how dropping viscosity even lower can help reduce diesel consumption.

“We're hitting [Starship 2.0] with the heaviest hammer that we have on the engine oil side for fuel efficiency,” Haumann said. “None of the OEMs recommend that you use a 5W-30 at this point, but we're pushing the envelope so that we can show that it's possible.”

This version of fully synthetic T6 was designed to meet the American Petroleum Institute’s (API) FA-4 performance standard adopted in 2016 to satisfy 2017 federal emissions standards. This standard for oils ending in W-30 provides “enhanced protection against oil oxidation, viscosity loss due to shear, and oil aeration as well as protection against catalyst poisoning, particulate filter blocking, engine wear, piston deposits, degradation of low- and high-temperature properties, and soot-related viscosity increase,” according to API.

FA-4 oils are not backwards compatible, unlike the CK-4 standard also released in 2016, which provides many of the same enhancements as FA-4 and can be used in all high-speed four-stroke cycle diesel engines. These two categories replaced the CJ-4 standard created in 2006 prior to the major overall of emissions standards. The CJ-4 formula had to account for the addition of aftertreatment systems, such as the diesel particulate filter (DPF).

The main advantage of FA-4 oils is that they fall between 2.9 and 3.2 centipoises (cP) on the high temperature/high shear (HTHS) test, measuring absolute viscosity. This will reveal the frictional drag of the oil. Because they have a lower absolute viscosity, they require less energy to pump through the system, thereby making them more efficient. FA-4 and CK-4 share a similar kinematic viscosity, which measures fluid resistance to gravitational flow.

Shear stability is not exclusive to FA-4, though. Cenex formulated polymer technology called EnduroVis for its CK-4 oils with shearing in mind, offering seven times more stability than competitors, according to the company.

Mimi Falkman, senior marketing specialist at CHS Lubricants, which makes Cenex products, explained that the “arms” of these advanced radial polymers to be more flexible and not succumb to breaking down due to mechanical stress. She said this allows the oil to retain 80% of its viscosity when the next oil change is due.

The polymer is used in Maxtron Enviro-EDGE and DEO to help restore fuel efficiency by 2% in normal conditions and 3% in extreme environments.

“We formulate these types of products in order to not only protect folks’ equipment but also to ensure that they're getting the most out of their different units because it can be pretty expensive and detrimental if one of them were to go down,” Falkman said.

Daimler Trucks North America (DTNA) began factory filling CJ-4 10W-30 in trucks with Detroit engines in 2016 to get better fuel efficiency and began using FA-4 10W-30 after 2017.

“FA-4 and CK-4 oils offer improved aeration and oxidation performance versus CJ-4,” said Len Copeland, product manager for Detroit Diesel engines, the powertrain arm of Daimler Trucks North America. “While FA-4 offers fuel economy benefits compared to CK-4 oils, both FA-4 and CK-4 oils are very reliable and meet the same performance criteria, such as wear protection.”

FA-4 has been approved for all Detroit engines EPA10 (model-year 2010) or later. John Loop, technology manager at additive supplier Lubrizol, confirmed FA-4 does supply the same effectiveness as CK-4.

“They both have to pass all of the same engine tests at the same pass/fail level, so they're not skimping out on anything durability-wise,” said Loop, who has been with Lubrizol for 20 years.

Loop has a penchant for ‘crude’ analogies and explained the difference between FA-4 and CK-4 this way: “The FA-4 guy that weighs 110 lbs. has to walk up to that 1,000-lb. dumbbell and put that over his head just as much as that 250-lb. [CK-4] linebacker.”

Overall, using either the API CK-4 or FA-4 should provide immediate fuel savings. Switching from the commonly used 15W-40 to a CK-4 10W-30 yields up to a 2% improvement in fuel economy, while a FA-4 10W-30 gets up to a 2.5% gain, Haumann explained.

Shell Rotella claims its T5 10W-30 diesel engine oil provides up to 2% fuel economy improvement over conventional 15W-40 and oil change intervals longer than 50,000 miles. The Rotella T6 Full Synthetic 0W-40 heavy-duty engine oil (CK-4) released a few years ago gives fleets a thinner solution that has better pumpability in cold weather. The lower ash content also reduces wear and tear on the engine and in the DPF.

Meanwhile, Chevron’s Delo 400 SDE 10W-30 promises up to 1% over the higher viscosity 15W-40. Boaty’s Transport, a food delivery fleet with 70 tractors, found a 2% increase with the Delo 400 ZFA 10W30 (FA-4). Chevron’s ISOSYN engine oil formulation used in its heavy-duty engine oils improved wear protection by 68%, piston deposit control by 46%, and oxidation control by 35% over the previous generation.

“The combination of engine protection and improved fuel efficiency is a real plus in helping us manage our costs in this competitive business,” Boaty’s owner Michael Boatwright said.

The newer Delo 600ADF, which has a 0.4% ash content, builds on these savings by providing even more protection for the aftertreatment system.

According to Citgo, fleets that use its CITGARD heavy-duty engine oils (10W-30 and lower) offer a 1.5% or better efficiency improvement, leading the company to offer a four-truck test in which fleets get double their money back if they don’t see a positive change over 15W-40.

Maintenance concerns

Fleets should make sure not to put an FA-4 certified engine oil in an engine not specified for it, as that could end up hurting fuel economy. “What you gain in reduction in friction, you may lose in pumping losses with the thinner fluid,” Haumann said.

Because fleets often have multiple makes and powertrains, the potential half-percent gain is not as critical as keeping things simple in the shop and preventing misfills, so the default is the highest viscosity.

“That's one of the reasons why these low viscosity oils, and FA-4 in particular, have not gotten as much traction in the marketplace as we had hoped,” Haumann said.

Falkman pointed out fleets may be holding off on FA-4 because of the backwards compatibility issue.

“It's a bigger jump for folks because a lot of people are still running older units, so there's a hesitancy to move to FA-4,” she said.

Glen McDonald, vice president of maintenance at Ozark Motor Lines, told FleetOwner that sticking to one oil does simplify things, though backwards compatibility can be an issue. The fleet of 750 trucks primarily uses Delo 400 ZFA 10W-30, an FA-4 certified engine oil.

“We have diesel APUs and yard equipment that require different oil,” McDonald said. “The benefits of the Delo product in the fleet outweigh the headache of having two oils.”

Copeland agreed that FA-4 has seen slower adoption, though customers have confirmed the fuel efficiency benefits. He said following published OEM guidelines and routine sampling of the engine oils will ensure the best results.

“Closely monitoring fuel economy trends can help detect issues before downtime occurs,” he said. “Also, engine oil isn’t the only part of the equation – high quality fuel, DEF (diesel exhaust fluid), and coolant work with the oil for complete engine and ATS reliability.”

TCO

As previously mentioned, a fleet’s choice of engine oil can affect more than just fuel consumption. As the industry has more experience with aftertreatment, the oil providers have been able to tweak their formulas to better respond to maintaining them.

Chevron found by lowering the sulfated ash content from 1% to 0.4% with Delo 600 ADF with non-metallic alternatives, the better the efficiency because ash buildup can restrict the exhaust flow.

“Testing sulfated ash content is a very good way to predict the impact that the lubricant has on ash accumulation in a DPF,” explained Shawn Whitacre, Chevron senior staff engineer for heavy-duty motor oils.

“The more back pressure or restriction you have in that system, that actually also robs the engine of efficiency,” Whitacre said. “And our testing has shown that over the life of the device, by keeping the ash accumulation low, the system actually operates closer to its original efficiency for a longer period of time. And that's a benefit that translates into about a 3% fuel savings over the life of the system.”

Testing Delo 600, Chevron found the DPF maintenance interval increased 2.5 times because less ash accumulates, Whitacre said. This would extend the life of the DPF past 1 million miles in some cases.

“That provides a big operational savings on top of the fuel efficiency gains,” he said.

He added ash can create piston deposits.

“As they develop over time, these can trigger loss of oil consumption control. So, by keeping that power cylinder free of deposits, you're keeping oil consumption low as well,” Whitacre explained. “It's sort of the double whammy of ash accumulation.”

Vocational fleets may benefit more by lowering ash, as they typically have higher rates of oil consumption, Whitacre said.

More insights are sure to be revealed as additive manufacturers, oil marketers, OEMs and fleets continue to run these oils and tear down engines. This could open the door for the 1 to 3% efficiency improvements of today to grow tomorrow.

Europe is in the process of tightening emissions standards, and in the U.S., NOx level limits are expected to drop from 0.05 g/bhp-hr in 2024 to 0.02 g/bhp-hr in 2027.

“There's still a lot of work to be done and a lot of improvements that still can be built into these complicated systems,” Whitacre offered. “We're always trying to tap into advancements and predictive capabilities that help us build better molecules that impart performance.”

He remained optimistic. “There's a lot of efficiency that can still be tapped into,” he concluded.

About the Author

John Hitch

Editor

John Hitch is the editor-in-chief of Fleet Maintenance, providing maintenance management and technicians with the the latest information on the tools and strategies to keep their fleets' commercial vehicles moving. He is based out of Cleveland, Ohio, and was previously senior editor for FleetOwner. He previously wrote about manufacturing and advanced technology for IndustryWeek and New Equipment Digest.