Trucking analysts project 'steady' improvements for 2022

Trucking entered 2022 still reeling from the effects of a supply chain hangover. Commercial vehicle production continues to lag far behind demand, and shortages of key materials such as steel, aluminum, and plastics have led to sharp price increases globally.

Gaps between maximum Class 8 truck production and actual production stem from supply chain difficulties, which have come up short by about 25%, according to FTR Transportation Intelligence data. Pent-up demand measured from April to December 2021 is about 93,000 units, a direct result of lower semiconductor deliveries to the OEMs, FTR noted.But there is a light at the end of this pandemic tunnel: once the supply chain stabilizes, commercial vehicle production will increase significantly, Don Ake, FTR’s VP of commercial vehicles, pointed out during a Jan. 13 State of Freight discussion.

“We’re looking for a higher build in 2022 and a very robust build in 2023,” Ake noted. “We are expecting a gradual improvement in the build rates throughout 2022. We’ve heard some indications that things are loosening up some. January will probably start [out] tough. But we think as we go throughout the year, there will be steady improvement."

“Because the supply chain is so clogged, we are not going to see the snapback in production that we’ve seen in previous cycles,” he continued. “The OEMs will still be limited to how much they can increase build, and labor—both at the suppliers and the OEMs—is an issue too. We expect the same thing for trailers. So not a snapback, but a gradual, steady improvement all year.”

On the trailer side of production compared to Class 8, Ake pointed to a smaller gap between maximum and actual production, with a pent-up demand of some 65,000 units.

“Comparing the two, you can estimate the impact in the truck market due to semiconductors is about a third of the total difference,” Ake said. “However, if semiconductors were not a problem, you would still have problems because parts and components are in short supply. It’s getting a little bit better, and we expect it to get better throughout the year, but it’s not back to where it needs to be.”

When comparing orders versus build in the Class 8 market, Ake said that in most cases, orders will be slightly ahead of the build because OEMs are not entering all the commitments they have. Instead, OEMs are managing their orders based on what they think they will be able to produce in the future, while also trying to anticipate what the supply chain is going to look like a few months ahead, he added.

“Once the supply chain starts to heal and starts to function better, you’re going to get higher production,” Ake advised. “When the supply chain issues start to get behind us, the OEMs are going to enter those commitments that they’ve been holding for a few months.

“The current backlog is close to the record backlog,” he added. “When those orders get entered, we’re going to have a new record backlog, and that will permit the OEMs to continue to build well into 2023 and probably beyond.”Trucking freight, capacity trends

While recapping the current freight environment, Avery Vise, FTR’s VP of trucking, pointed out that spot market metrics continue to be strong. That’s especially true for the van segments, with dry van ending 2021 with total spot rates and volume that continue to outpace 2020.

Refrigerated also had record volume to close out 2021.“Volume and rates are still running well ahead of the five-year average, and rates especially are geared to be quite resilient—going up, but keeping up more or less with seasonal expectations,” Vise noted. “The spot market represents only about a third of the market—perhaps a little more over the last year-and-a-half or so. It also tends to overrepresent volume in times of disruption.”

Because of capacity and productivity challenges in the spot market, rates have been outperforming volume. FTR estimates that total truckload rates were about 19% higher in 2021 than in 2020, while spot rates were up about 29%, and contract rates up about 14%. Seasonally adjusted rates for those three segments are well ahead of rates in 2017 and early 2018, Vise added.

“Through most of 2021, we basically needed all the trucks we could get to keep freight moving,” he said. “That percentage has eased just a bit recently, as freight demand has stabilized slightly, and capacity has come up slightly. Those changes are enough to fundamentally change market conditions in the freight rate environment.”

When it comes to driver capacity, growth in the local general freight segment is offsetting declines in every other trucking segment, with the exception of LTL, Vise pointed out. The production non-supervisory employee level—which is more indicative of the truck driver market—in local general freight is up nearly 8% since February 2020, according to Bureau of Labor Statistics data. However, the over-the-road freight, long-distance truckload segment is still down 4.5% since February 2020.

“It’s important to recognize that not all of the truck drivers are payroll employees,” Vise explained. Leased owner-operators are not counted in payroll employment figures, but company drivers are.

“The share of drivers who are payroll employees, we believe, has clearly shrunk during the pandemic, reflecting the same trend that we have seen in the economy as all business applications relay up throughout the economy and there are a lot of entrepreneurships,” Vise added. “We are seeing the same thing in trucking.”

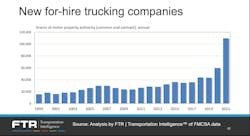

In 2021, for instance, the Federal Motor Carrier Safety Administration authorized nearly 110,000 new for-hire trucking companies. That is 85% more than in 2020, which was the beginning of the surge in mid-year, Vise pointed out.“And [that is] 150% more than what we saw in 2018 and 2019, which basically were about the same and the strongest years ever up until that point,” he added.

Vise projects that most of these new carriers were likely leased owner-operators who got their own authority. FTR estimates that carriers who started since July 2020 and are still in business account for nearly 169,000 truck drivers. More than 70% of those carriers have just one driver and are almost certainly not counted in the BLS payroll employment numbers, Vise added.

“When we look at the payroll employment sector, which is almost fully recovered, and we see this trend, what we find is that we almost certainly have more truck drivers today than we did before the pandemic,” Vise said, adding, however, that distribution of those drivers is an issue.

Many of those drivers have moved from long-haul to local, while others have moved from larger truckload carriers to the spot market and to 3PLs, Vise explained.

“The shift of capacity has been disrupted, as shippers have not been able to sort capacity reliably with the core truckload carriers they had been accustomed to using in their route guides,” he said. “That has shifted more freight to the spot market, which, in turn, has attracted more capacity to the spot market.”

Looking ahead into 2022, Vise said the key question is whether capacity will continue to shift away from traditional truckload carriers to the intermediary environment.

“If we continue to see strong spot rates then we probably will see that trend continue,” Vise said. “Unless rates continue to rise, it probably will slow down if for no other reason than we’re running out of trucks that are going to be available to these carriers.”

About the Author

Cristina Commendatore

Cristina Commendatore is a past FleetOwner editor-in-chief. She wrote for the publication from 2015 to 2023.