DAT: Spot load availability soars

As expected, the number of available loads on the spot truckload freight market surged last week compared to the previous week, which was shortened by the Thanksgiving holiday, according to a DAT Trendlines report.

The spot van load-to-truck ratio is the highest since June 2014; the refrigerated ratio is at its highest since March 2015:

- Van L/T: 4.7 (up 61%)

- Reefer L/T: 8.2 (up 36%)

- Flatbed L/T: 18.8 (up 27%)

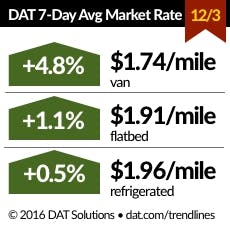

With demand on the upswing, rates rose across all three equipment types:

- Vans: $1.74/mile, up 8 cents

- Reefers: $1.96/mile, up 1 cent

- Flatbeds: $1.91/mile, up 2 cents

Those rates include a fuel surcharge. The average price of on-highway diesel gained 2.4% compared to the previous week at $2.48/gallon.

Van Loads Soar: The number of van load posts soared 80% and truck posts increased 11% week over week. Spot van rates stayed strong in key regional markets:

- Chicago, $2.09/mile, unchanged

- Dallas, $1.57/mile, up 2 cents

- Charlotte, $2.02/mile, up 5 cents

- Buffalo, N.Y., $2.12/mile, up 10 cents

- Los Angeles, $2.16/mile, down 3 cents

- Crops out of Green Bay are mostly finished and prices on some lanes fell hard. Green Bay-Joliet, Ill., was down 36 cents to $1.97/mile

- Out of California, loads on the Ontario-Chicago lane paid 20 cents less last week at $1.71/mile, and Fresno-Boston slipped 17 cents to $1.91/mile

- Miami rates slipped after big gains in the previous week. Miami-Boston fell 22 cents to $1.63/mile, and Miami-Elizabeth, N.J., dropped 21 cents to $1.47/mile

Flatdecks Bounce Back: Flatbed demand bounced back after Thanksgiving: the number of flatbed load posts increased 59% and truck posts gained 26% compared to the previous week.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.