After a year of unparalleled economic growth in 2018, 2019 sputtered to the finish line, creating volatility in trucking operations and costs, according to findings released this week by the American Transportation Research Institute (ATRI).

The research organization’s 2020 update to its annual “An Analysis of the Operational Costs of Trucking” uses detailed financial data provided directly by motor carriers of all sectors and fleet sizes to document and analyze trucking costs from the previous two years. ATRI’s “Ops Cost” analysis offers trucking industry stakeholders a benchmarking tool to help with comprehensive transportation planning and infrastructure improvement analyses.

“Given the chaos and volatility of freight markets these days, it is more critical than ever that trucking fleets closely monitor their cost centers,” said Brandon Knight, principal of transportation for CliftonLarsonAllen. “ATRI’s Operational Costs report is an important benchmarking tool for fleets of all sizes and sectors.”

ATRI’s 2020 Ops Cost report documents the slowdown of freight during the second half of 2019. The economic softening, combined with a number of independent factors including cheaper fuel prices, decreased the marginal cost of trucking.

Most cost center trend lines in trucking dropped last year, ATRI found:

- Fuel costs dropped 4 cents from 2018 to 39.6 cents per mile in 2019, as truck capacity demand slackened;

- Repair and maintenance costs fell almost 3 cents to 14.3 cents per mile, reflecting a slower maintenance schedule;

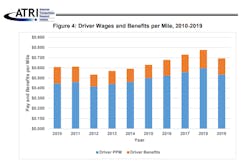

- Wages and benefits both fell in 2019, but bonuses increased, indicating that fleets were hesitant to lose drivers should the economy come roaring back in the near future;

- Other cost centers dropping from 2018 levels were equipment lease and purchase payments, tires, and permits.

ATRI said one of the most surprising cost decreases in 2019 was truck insurance premiums, which fell by an average cost of 1.6 cents per mile after increasing “nearly every year since 2012, with some years experiencing double-digit increases,” according to the document. “After mining the data and reviewing it with insurance industry experts, the conclusion was clear: trucking fleets are maxed out on their ability to absorb another year of higher insurance premiums, and have responded by dramatically increasing deductibles, reducing excess insurance coverage and moving to ‘captive insurance programs.’ While these short-term approaches to manage cost increases appear to be stabilizing insurance costs, the long-term result is a potentially catastrophic increase in accrued carrier risk.”

The average marginal cost per mile incurred by motor carriers in 2019 decreased by 9.3% to $1.65. Almost every major line-item expense experienced some level of decrease. Compared to the last freight softening in 2016, marginal trucking costs were 6 cents higher in 2019, indicating the persistence of generally higher costs, according to ATRI’s findings.

Combined driver wage and benefits decreased slightly in 2019 — from 77.6 cents per mile in 2018 to 69.3 cents per mile — a counterintuitive decrease given the driver shortage. However, bonuses for drivers universally increased, with retention bonuses showing increases of over 80%. While the cost per mile for total driver compensation fell, carriers are clearly addressing the driver shortage through other mechanisms.

ATRI’s 2020 report includes a targeted analysis on “Driving the Trucking Industry: Small Carrier Spotlight,” which compares fleets of 100 or fewer trucks to fleets with greater than 100 trucks.

Looking to 2020, ATRI expects data to reflect what has been “the most impactful year of social, medical and economic change seen in many generations.” But the non-profit research group said that until the year ends and data is collected and analyzed, only anecdotal analyses are available. But with rising freight demands across the nation in 2020, ATRI said it is likely to see driver wages on the rise in 2020.

“As always, the trucking industry’s ability to respond quickly to long-term economic trends, such as e-commerce growth, favors an increase in trucking’s market share,” the report concludes. “In addition, trucking is seen as resilient in short-term downturns as seen in late 2019, and responsive in times of crisis, such as the COVID-19 pandemic. Overall, the trucking industry’s economic health, while tied to many externalities including national policy shifts, appears to be strong far into the future.”

A copy of this report is available here.