Key takeaways

- Spot rates move with real-time supply and demand; high load-to-truck ratios push shippers to pay more to secure capacity.

- Contract rates trade flexibility for stability—locking in volume and pricing, but lagging market shifts by months.

- Segment and economic cycles drive earnings: flatbed, reefer, and dry van react differently to capacity swings and freight demand.

In for-hire trucking, shippers pay carriers to move freight. This payment is generally a per-mile rate with a fuel surcharge.

Freight rates are the primary source of income in for-hire trucking and a major indicator of the industry's health.

Rates are the products of countless market conditions. Different trucking segments have slightly different rates, particularly between spot and contract freight.

This is part of FleetOwner's Fleets Explained, a Trucking 101 series to break down aspects of the trucking and fleet management industries. You can read more from the series, launched in May 2024, at fleetowner.com/fleets-explained. To submit topic ideas, clarifications, and corrections, email [email protected].

What are spot rates?

The word spot is a general financial term for a short or immediate timeframe, similar to the phrase “on the spot.” In trucking, a spot rate is the cost of quickly moving specific freight or a load. Spot rates are the short-term counterparts of longer-term contract rates.

Fleets and brokers/shippers agree on a spot rate to haul specific immediate freight, which can be called spot freight or a spot market load. The environment surrounding these transactions is the spot market.

The spot market mostly takes place on load boards. Load boards are platforms that allow shippers/brokers to post spot freight they need to be hauled and enable carriers to bid on those postings.

According to RTS, major spot load boards include DAT One, Truckstop, 123Loadboard, and Direct Freight.

How do spot rates work?

According to Penske Logistics, spot rate quotes reflect real-time market conditions: how much it costs to ship cargo on the spot. Broadly, cost is a function of the freight market’s supply and demand. More specifically, however, rates vary based on numerous factors, including the type of freight, the weight of the shipment, the length of the route, fuel costs, available drivers, the weather, and the shipper’s sense of urgency.

These market conditions affect individual shipper and carrier behaviors, which in turn affect rates. If a shipper posts a spot load on a board for an appropriate rate, a carrier might quickly accept the load.

When the load-to-truck ratio rises, for example, a load posting for the original rate is less likely to be accepted by a carrier. The shipper would need to pay a higher rate to get their spot freight hauled quickly.

What are contract rates?

Contract rates come from long-term contracts between shippers and carriers. The negotiated rate is, to some degree, fixed for the duration of the contract; this is in contrast to the real-time changes seen in spot rates.

According to Translogistics, contract freight is less flexible than spot freight—but is more predictable. In exchange for this assured business and predictability, contract rates tend to be slightly lower than spot rates. Contracts also often come with additional requirements, such as tracking, insurance, and specialized cargo handling.

Long-term contracts are generally negotiated discretely between shippers/brokers and carriers without the assistance of a load board marketplace.

How do contract rates work?

Though contract rates are not as immediate as spot rates, they are still determined by the same factors that influence supply and demand. Long-term contractual agreements lend these rates a rigidness that insulates shippers and carriers from market volatility.

Throughout the contract term, the rate will tend to reflect market conditions from the time of contract negotiation rather than real-time conditions.

“It’s an artifact of buying forward versus buying now,” Ken Adamo, chief of analytics for DAT Freight & Analytics, told FleetOwner.

“That lead-lag relationship can be as short as a couple months; sometimes it could be a little stubborn and be four to six months. A lot of it has to do with how long the contracting cycle is,” Adamo explained. “We’ve seen during COVID the contracting cycle shortened considerably. As things have normalized in a post-pandemic world, that contracting cycle has lengthened.”

How do trucking segments affect rates?

Rates behave differently among different trucking segments, particularly between cargo and equipment types.

For example, flatbed loads tend to have higher rates than refrigerated loads, while refrigerated loads tend to have higher rates than dry van. This same trend is reflected in load-to-truck ratios: The flatbed segment generally has the highest ratio of the three, while dry van has the lowest.

These rates vary because each segment has unique market conditions. The risks and labor required to haul each type of cargo are a major factor.

Dry van freight can haul various general goods within a fixed-size container. Refrigerated goods require great care to ensure their trailer maintains a controlled environment and fixed temperature, lest the food or chemicals being hauled go bad. Flatbed cargo often carries large freight that cannot fit in a dry van. This freight needs to be secured with locking devices and may also be oversized.

The rate for hazardous cargo and any freight requiring specialized care is typically higher than for general goods. Specialized care and regulatory compliance add to the cost of hauling the goods, and the freight may also be limited in what routes it can take.

How do business cycles affect freight rates?

One important factor for freight rates—and the trucking industry generally—is the economic cycle, or business cycle.

Business cycles are broad patterns of expansion and contraction within a given market. A cycle can take place with any datapoint, in any market, under any reasonable timeframe (generally, to the scale of months and years). Britannica Money describes these cycles as "the recurrent boom-and-bust phases that markets and economies typically exhibit."

These cycles affect rates in several ways. The industries that produce haulable goods—like manufacturing, construction, retail, agriculture—experience their own cycles of boom and bust. The markets for the haulable goods themselves, such as the avocado market, experience their own cycles. Trucking has its cycles, and the entire U.S. economy has its cycles.

If the avocado market is in a boom phase, refrigerated loads out of California will be in high demand and rates will likely rise. If construction is in a bust, flatbed load rates will suffer.

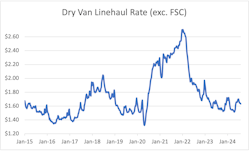

As an example, take a look at DAT's average linehaul rate for dry van loads across nine years, from January 2015 to August 2024.

Looking at the chart above, it looks like DAT's measure of dry van freight rates experienced about three major boom-and-bust cycles since 2015. Rates peaked around January 2015, mid-2018, and January 2022. Rates fell to their cyclical troughs around mid-2016, January 2020, and from mid-2023 through mid-2024.

These cycles are built by the same factors of supply and demand as those affecting individual rates. An excess of available carriers brings rates down—excess capacity is one major factor contributing to the latest trough in this nine-year rate chart.

How does your fleet earn its freight rates? Are you curious to see how other readers would answer? Try out this survey below.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.