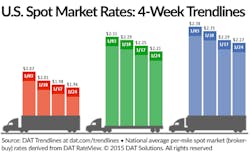

Spot market volume slipped and average truckload rates edged downward during the week ending Jan. 24, reported DAT Solutions, which operates the DAT network of load boards.

The number of loads posted on DAT boards fell 19% against a 15% increase in the number of trucks posted compared to the previous week. The slowdown in freight and rate growth follows typical seasonal patterns, DAT noted.

Some key metrics from DAT Trendlines for the week:Load-to-truck ratios drop: The number of available vans increased 16% for the week. This pushed the van load-to-truck ratio from 3.1 to 2.2, meaning there were 2.2 van loads posted for every available van on DAT load boards last week, the lowest mark since November 2013. Flatbed capacity increased 14% as the flatbed load-to-truck ratio fell from 13.7 down to 10.0 loads per truck. The reefer load-to-truck ratio declined from 10.1 to 6.9 reefer loads per truck.

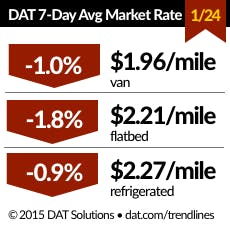

Spot rates slide: With more capacity on the market, the national average van rate fell 2 cents to $1.96 per mile (the line-haul portion of the rate slipped 1 cent and the average fuel surcharge lost 1 cent). Despite the average van rate from Los Angeles falling 9 cents to $2.00 a mile on congested port traffic, the West was the only region to see average rates rise, including a 4-cent increase out of Denver ($1.38 per mile).

The national average flatbed rate was $2.21 per mile, off 4 cents, and the rate for refrigerated freight dipped 2 cents to $2.27.Fuel tumbles: The national average fuel price ended the week down 6 cents at $2.87 per gallon. Declining fuel prices tend to have a dampening effect on spot market rates. When fuel prices slip, the surcharge drops and the total rate may decline accordingly.

Load-to-truck ratios represent the number of loads posted for every truck available on DAT load boards. The load-to-truck ratio is a real-time indicator of the balance between spot market demand and capacity. Changes in the ratio often signal impending changes in rates, according to DAT.

DAT Trendlines is a weekly report on spot market freight availability, truck capacity, and rates.

About the Author

Sign up for our eNewsletters

Get the latest news and updates