Spot freight loads on the rise, rates firm

Feb. 26, 2015

2 min read

Load availability on the spot truckload market increased 8.6% while capacity fell 9% during the week ending Feb. 21, reports DAT Solutions, which operates the DAT network of load boards.

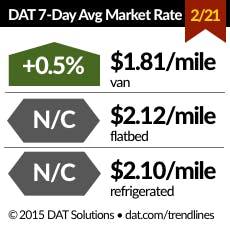

Average line-haul rates were unchanged across all three equipment categories compared to the previous week, holding steady after several weeks of decline.

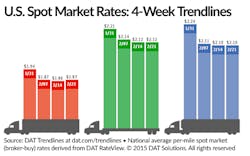

The national average van rate including surcharge was up 1 cent to $1.87 per mile on the strength of a rising diesel price and an uptick in the fuel surcharge.

While rates elsewhere were generally flat, outbound van rates rose significantly in Buffalo and Columbus, OH (both up 7 cents to $2.13 per mile), and Memphis (up 9 cents to $2.17). All three markets have been affected by winter weather, DAT noted.

The national average flatbed rate was unchanged at $2.12 per mile compared to the previous week but was down 9 cents from the January average. The reefer rate was unchanged at $2.10 and down 13 cents from the January average.

There was less available capacity on DAT load boards for the week, sending load-to-truck ratios higher.

The number of flatbed loads posted on the DAT Network fell 1.9% while available capacity declined 11%. The flatbed load-to-truck ratio increased slightly from 11.1 to 11.3, meaning there were 11.3 flatbed loads posted for every available flatbed trailer on DAT load boards last week.

Reefer load availability increased 14% and capacity fell 11% last week, reversing the prior week’s trend. The reefer load-to-truck ratio jumped from 6.2 to 7.9 loads per truck.

And demand for vans rebounded 15% last week and capacity fell 9.4%. The resulting van load-to-truck ratio rose from 2.1 back up to 2.7 loads per truck.

Load-to-truck ratios represent the number of loads posted for every truck available on DAT load boards. The load-to-truck ratio is a sensitive, real-time indicator of the balance between spot market demand and capacity. Changes in the ratio often signal impending changes in rates.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. For complete national and regional reports on spot rates and demand, visit dat.com/Trendlines. DAT Trendlines is a weekly report on spot market freight availability, truck capacity, and rates.

About the Author

Sign up for our eNewsletters

Get the latest news and updates