Spot market rebounds to finish February, but month closes lower

March 6, 2015

3 min read

Freight availability on the spot truckload market rebounded 14% and capacity dipped 0.8% during the week ending Feb. 28, according to DAT Solutions, which operates the DAT network of load boards and publishes DAT Trendlines. But the uptick wasn’t enough to rescue the month overall as the available loads fell and capacity crept upward.

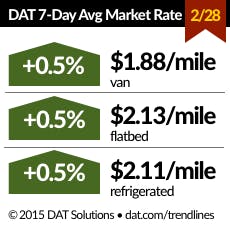

For the week, average rates responded with a 1-cent increase across all three equipment categories compared to the previous week, with average outbound spot rates gaining on the strength of rising fuel surcharges, according to DAT’s analysis.

The national average van rate picked up 1 cent to $1.88 per mile on the strength of several key van markets. Memphis increased 12 cents to $2.30 per mile; Columbus, Ohio, jumped 3 cents to $2.15 per mile; Dallas was up 6 cents to $1.76 per mile; and Buffalo rose 4 cents to $2.22 per mile. Outbound van rates from Los Angeles rose 4 cents per mile to $1.92 as the dockworkers and West Coast port operators reached a tentative labor agreement.

The national average flatbed and reefer rates each rose a penny to $2.13 and $2.11 per mile, respectively.

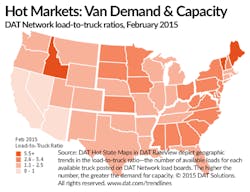

Van freight availability on DAT load boards increased another 19% last week while capacity remained stable (down only 0.8%) compared to the previous week. That pushed the load-to-truck ratio up 19.5% from 2.7 loads per truck to 3.2, meaning there were 3.2 van loads posted for every available van trailer on DAT load boards last week.

Reefer freight availability rose 18% for the week and capacity declined 2.9%, which boosted the reefer load-to-truck ratio by 21% from 7.9 to 9.5. Flatbed load availability increased 10% while capacity added 1%; the flatbed load-to-truck ratio recovered 9% from 11.4 to 12.4.

For the full month of February, loads were down 7.2% from January and 28% from the year before. Spot market capacity edged up 1.1% from the previous month, and surged 53% from February 2014.

Compared to January, truckload spot rates fell 3.15%; flatbed was down 3.6%; and refrigerated was off 5.4%. Rates were similarly down from the year before.

Load-to-truck ratios represent the number of loads posted for every truck available on DAT load boards. The load-to-truck ratio is designed to be a sensitive, real-time indicator of the balance between spot market demand and capacity. Changes in the ratio often signal impending changes in rates, DAT notes.

About the Author

Sign up for our eNewsletters

Get the latest news and updates