Spot rates hold to seasonal trends, weather’s impact localized

January is typically slow in the spot truckload freight market, and so far this year fits the pattern, reports DAT Solutions, which operates the DAT network of load boards.

Load volume and average truckload rates drifted downward during the week ending Jan. 31. The number of loads posted on DAT boards fell 6.1% and the number of trucks posted increased 0.1% compared to the previous week.

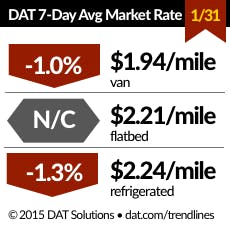

Some key metrics from DAT Trendlines for the week:

Stormy weather, seasonal norms: The national average van rate fell 2 cents to $1.94 per mile (the line-haul portion of the rate slipped 1 cent and the average fuel surcharge lost 1 cent), in line with seasonal norms.

The first big winter storm of 2015 was a test for supply chain managers and carriers who added equipment, hired more operational employees, and improved procedures and infrastructure after last year’s transportation fiasco, the DAT analysis notes.

The average spot van rate out of Buffalo rose 12 cents to $2.15 per mile last week, but in general snowy weather in the Northeast had a marginal effect on the market. The worst weather materialized over the weekend, giving businesses a chance to plan ahead. Also, storms were localized over New England and New York, unlike last year when harsh conditions were more widespread.

The national average flatbed rate remained at $2.21 per mile, while the rate for refrigerated freight fell 3 cents to $2.24.Van, reefer load-to-truck ratios fall: Van freight availability continued a seasonal adjustment with an 8.4% decline in the number of van loads posted to DAT load boards.

Available van capacity increased 19% compared to the previous week. The van load-to-truck ratio dropped from 2.2 to 2.0 loads per truck, meaning there were 2.0 van loads posted for every available van on DAT load boards last week.

Demand for reefers declined 7.3% and capacity added 3.6% in a typical trend for late January. The reefer load-to-truck ratio fell from 6.9 to 6.1 reefer loads per truck.Flatbed load availability dipped 3.2% and capacity edged up 0.2% last week. The resulting flatbed load-to-truck ratio held steady at 10.0 loads per truck.How low can fuel go? The national average fuel price ended the week down 4 cents at $2.83 per gallon. Declining fuel prices tend to have a dampening effect on spot market rates, DAT notes. When fuel prices slip, the surcharge drops and the total rate may decline accordingly.

Load-to-truck ratios represent the number of loads posted for every truck available on DAT load boards. The load-to-truck ratio is a sensitive, real-time indicator of the balance between spot market demand and capacity. Changes in the ratio often signal impending changes in rates.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. RateView's database is comprised of more than $24 billion in freight bills in more than 65,000 lanes.

For complete national and regional reports on spot rates and demand, visit dat.com/Trendlines.