By the numbers: January freight, rates indicate market turn for the better

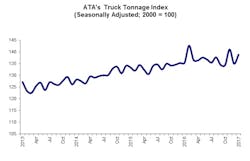

The for-hire truck tonnage index compiled by the American Trucking Assns. (ATA) jumped 2.9% in January, after falling 4.3% in December, a sign that “the freight economy is starting to show some signs of life,” according to Bob Costello, chief economist for the trade group.

Compared with January 2016, the index increased 2.6%, he added, with tonnage up 2.5% for all of 2016 versus 2015.

“Looking ahead, the most recent positive sign for truck tonnage is the large drop in the inventory-to-sales ratio during December. The decrease put inventories throughout the supply chain, relative to sales, to the lowest level in two years,” Costello says.

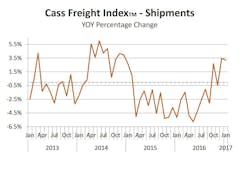

Similarly, both the shipments and the expenditures tracked by the Cass Freight Index have turned positive.

“Throughout the U.S. economy, there is a growing number of data points that suggest that the worst is over and the economy is getting better,” the latest monthly report says. “Some data points are simply less bad, but an increasing number of them are better, and even a few are becoming outright strong.”

And the 3.2% increase in the January Cass Shipments Index is yet another data point which strongly suggests that there may have indeed been a change in trend, according to Cass.

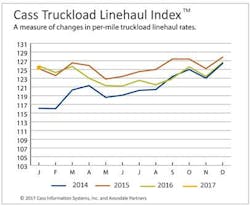

The Cass Freight Expenditures Index also signaled a turn in trend. Expenditures (or the total amount spent on freight) turned positive for the first time in 22 months—albeit against an easy comparison, Cass notes.

After an extended period of soft demand and excess capacity, "we are...seeing some improvements in pricing power of truckers," notes Donald Broughton with Avondale Partners, who provides analysis for Cass.

The proprietary Cass Intermodal Price Index (which does include fuel and other charges) faired even better, increasing 3.8% in January, up from the 1.5% increase in December and the fourth YoY increase after 21 consecutive months of decline.

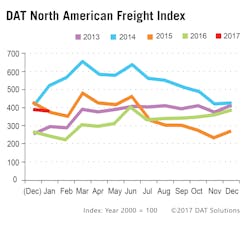

On the spot market, the DAT North American Freight Index edged downward in January as freight and rates “settled into a typical post-holiday pattern, albeit at significantly elevated levels compared to this time last year,” according to DAT Solutions.

Spot van, refrigerated, and flatbed rates in January were higher year over year, but an influx of capacity from contract carriers onto the spot market, particularly on high-traffic lanes, depressed rates compared to December.

"Coming off a high in December, January was still very solid for spot freight," said Don Thornton, Senior Vice President at DAT. "As a result we saw more contract carriers make their trucks available on load boards, and the added capacity contributed to lower rates on many high-traffic lanes.”