The pandemic and new coronavirus variants can’t slow down the U.S. economy—but it is creating a lot of volatility that will be felt in the trucking and transportation industries through 2022, according to the analysis of FTR Transportation Intelligence.

Four economic risks are facing the transportation industry the rest of this year: the pandemic, labor supply, consumer spending, and inflation, according to Avery Vise, FTR’s vice president of trucking, who led an in-depth webinar on the trucking industry outlook on Sept. 2.

FTR is forecasting a 6% increase in total truck loadings coupled with an 18% increase in truckload rates by the end of this year. The economists and analysts at FTR expect rates to remain flat in 2022 as total loading increase 3.4%. Ongoing supply chain disruptions are keeping the spot market hot, which has driven many drivers to create their own companies—more than 100,000 new carriers were established in the past year. But what happens to these smaller operations when the market eventually stabilizes?

Freight's uncertain future

Vise attempted to look into this uncertain future for U.S. freight as the country continues to grapple with a pandemic that has now stretched on for 18 months.

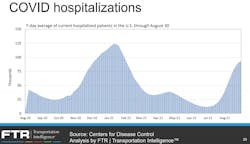

Up until mid-July, the COVID-19 pandemic appeared to be fading away. But as vaccination rates slowed, the delta variant of the virus emerged in the U.S., increasing cases and hospitalizations. “At this point, we haven’t seen data that suggests the delta variant is causing economic damage—but it’s still early,” Vise said. “There is some hope here as it appears—and I stress appears—that a peak may be forming if you look at recent data.”

COVID cases and hospitalizations have slowed from the surge seen in the past two months. But that’s no reason to think the pandemic will be over soon, Vise said. “Even if the current wave is peaking, it doesn’t mean that we won’t have other variants or other waves,” he said. “Let’s face it, this is probably going to be an issue we’re going to be dealing with for the rest of this year, potentially into next year. Some people think we’re going to be dealing with it for a prolonged period of time.”

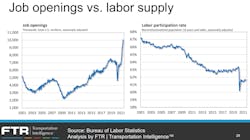

More than a year after the pandemic began here, the U.S. economy had more than 10 million job openings—the most on record this century. “Each of the last five months was a record at the time,” Vise said of the Bureau of Labor Statistics, which has tracked the metric since 2000.

A big factor in the labor market is participation, which Vise said has not increased much in 2021. He said some of this could be attributed to more parents staying home with children attending schools virtually, which might change as more schools reopen to in-school classes this fall. Others have left the labor market early for retirements and other reasons.

With an insufficient labor force, economic growth is stifled, Vise notes. “It also contributes to other economic and freight risks,” he said.

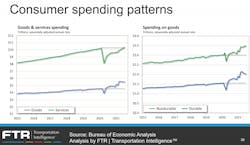

As the calendar gets later in 2021, record retail sales are at risk as stimulus money that helped fuel consumer spending faded away. “We would expect spending to rise positivity as employment rises, but it’s not likely that we can maintain the recent pace of retail sales,” Vise said.

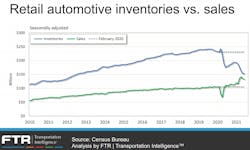

He added that this future is murky as retail sales are tied to several factors, including auto sales, which have slowed considerably with the semiconductor shortage that has slowed new vehicle builds. “Assuming those inventories return, we could get a boost in durable goods spending at some point—the question is when,” Vise said.

That semiconductor shortage “is at the root of the problem,” Vise noted later in his presentation. This creates a lot of pent-up demand just to replenish new vehicle inventories as dealers’ lots are more empty than normal. “People just can’t find the vehicles they want, so they aren’t buying and that’s contributing to the reduction in sales.”

The automotive industry is tightly tied to inflation, which is another risk on the U.S. economic horizon as the Consumer Price Index has surged “like we had not seen in nearly 40 years,” he said. “While we did get considerably better figures in July, that’s only in relation to the most recent months. Inflation is still elevated compared to the norm.”

Inflation reduces consumers’ ability to buy goods as their money doesn’t have as much value as prices increase.

Excluding food and energy, which Vise noted are traditionally volatile markets, inflation is up 4% over the past 12 months. “That is very high compared to the past few decades,” he said. “It’s important to note that recent inflation is very much linked to what’s going on in automotive. In recent months, where inflation rose, the index for used cars and trucks accounted for about a third of the increase.”

Freight risks

With these economic risks, FTR has found several freight and trucking risks on the horizon. “If you’re a shipper, I hate to tell you this but, most of these risks are probably in the direction of continued disruption of freight networks and therefore continued strong pricing,” Vise said. “But there is a glimmer of hope for you because one of the risks is very much in the other direction.”

The biggest risks for the trucking freight market right now include competitive issues with rail and intermodal service, supply chain disruptions, and carrier stability in a weak driver market.

The upshot for for-hire trucking carriers, Vise said, “is that many shippers are finding intermodal an unreliable alternative. That’s keeping more upward pressure on trucking than you otherwise might expect—given how high trucking freight rates are.”

Adding to this pressure are “all the problems that we’re seeing surrounding ocean freight capacity and congestion at the ports,” Vise explained. By the time shipments reach the ports, “they are already running behind schedule—in many cases very behind schedule. And that just further encourages transloading and substitution of trucks for rail intermodal because time is money. Especially as we’re getting closer to peak season, that’s even more true.”

But tight maritime capacity and port congestion is just one part of the bigger supply chain disruption in the U.S., Vise noted. Another piece of the problem is “how tight inventories are relative to sales,” he said. “We are essentially at record levels, which of course makes other disruptions that much more disruptive because there is not a lot of cushion. And wholesale inventories are the leanest they’ve been in nearly seven years.”

Most of that low inventory ratio pressure comes from automotive, where inventories are down about 34% from February 2020, the last full month before the pandemic began. “On the other hand, retail inventories excluding automotive are about 8% higher than they were in February of last year,” Vice added. “That’s probably higher than they would have been absent the pandemic—but then again, we’ve had extraordinarily strong retail sales for really the last year and especially this year with two rounds of stimulus.”

The semiconductor shortage hampering the automotive sector is creating two issues, Vise said. “One is that we’re seeing variable production, especially in automotive, but in a lot of the supply chain,” he explained. “That is one of the reasons why the spot market is so hot—that lack of stability is a disruption that is keeping the spot market strong.

“Second thing is, even when things stabilize, we likely are going to have demand for capacity that is needed to haul all the components that automotive needs in order to replenish those inventories. That’s going to keep the driver supply tighter than we otherwise normally would see.”

Vise’s final peg in the current freight market disruption is a burst of new for-hire trucking companies registering with the Federal Motor Carrier Safety Administration. Between July 2020 and July 2021, nearly 110,000 new for-hire carriers were authorized by the FMCSA. About 70% of those new carriers, Vise said, have just one driver. That makes Vise believe many of them were leased owner-operators who had been operating under a larger carrier’s authority.

“But some number of them are company drivers, and to the extent that that’s the case, it’s creating something of an artificial depth deficit in payroll employment,” Vise said. This contributes to the hot spot market as the larger carriers contend with losing drivers to smaller operations.

Once the supply chain stabilizes down the road, Vise theorized that many new carriers contract as spot rates decrease and drive down profit margins. He anticipates that would drive those smaller operators “back to the security and stability of larger trucking companies,” Vise said. “Quite suddenly, everyone will no longer be talking about the driver shortage. It’s a good theory. The question is: When will this happen? I don’t have an answer for that.”

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.