The overall U.S. economy closed out 2021 in emphatic fashion—but not nearly as strong as the trucking industry wrapped up the year. The freight industry shows few signs of slowing down this year. After living off a surge in consumer spending last year, trucking’s 2022 growth could be built off a surging industrial sector, based on FTR Transportation Intelligence analysis and forecasts.

The fourth quarter “was fantastic for the freight economy,” according to Avery Vise, FTR’s VP of trucking. FTR expects the trucking industry to continue to bolster the U.S. economic charge through 2022 before things return to a more normal pace by 2024.

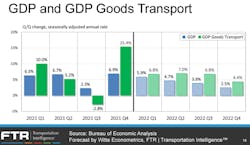

U.S. GDP jumped 6.9% in Q4, its most significant quarter-over-quarter increase since Q3 2020—when businesses began reopening from early COVID-19 lockdowns that plagued the economy in the spring of 2020. The goods transport sector of GDP also saw its quarter-over-quarter growth (15.4%) since 2020.

More than half of that GDP growth came from a sharp increase in inventory investment across the country, Vise explained during an FTR State of Freight webinar on Feb. 10. “That's important because we tend to think of inventory build as a warning sign for future demand,” he said. “Now the idea, of course, is if you build inventories in the near term, demand to add even more inventory generally wanes.”

If those inventories continue to build, it could be concerning for the industry’s long-term outlook, Vise said later. But FTR’s current outlook for 2022 includes quarterly GDP goods transport growth of at least 6.8% through Q3 before “GDP starts slowing by year-end,” Vise said, before noting there are some risks to this forecast as it gets farther into the future.

Diesel prices cause some volatility

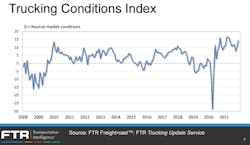

FTR’s Trucking Conditions Index, which Vise described as the “broadest metric for measuring market conditions” for trucking companies, accounts for freight rates, capacity, utilization, fuel costs, capital, and more. “Not surprisingly, the TCI has been running at very strong levels for over a year—after plunging to its worst reading by far in April 2020,” Vise said. “The index has become more volatile lately due to big swings in diesel prices.”

But even fuel costs haven’t stymied the TCI because other freight dynamics have remained high since the COVID-19 dearth nearly two years ago. December’s TCI was the strongest since May 2021, which followed a TCI record the previous month. “The January (2022) reading is not finalized yet—but it is almost certain to be lower due to the surge in diesel prices that we’ve been experiencing,” Vise noted.

Vise pinned the robust trucking market conditions to active truck utilization rates, which stayed above 96% since late 2020. The rate, which measures the number of trucks needed to haul freight divided by the number of available trucks, only dipped below 98% twice in 2021.

“Except for a bad month in February of last year, active utilization was essentially maxed out all through 2021 until we got to August,” Vise explained. “Since then, the stress has eased slightly—but not really enough to change near-term market conditions. It has been barely enough to take the edge off our growth forecast impact for rates in 2022.”

While truck utilization remained around 98% in the final months of 2021, Vise said FTR forecasts it to stay above 97% this year. He said this freight market surge doesn’t compare to the previous hot market in 2017-18 that led to truck utilization falling from near-capacity in early 2018 to sub-90% by mid-2019. “The difference is that we have far more headwinds for driver capacity gains and gains in productivity than we did in 2018,” he said.

Looking into the future, FTR doesn’t expect many utilization changes. “We’re really seeing too much strength in freight on the one hand and too many headwinds for further capacity and productivity gains on the other,” Vise said.

Truck freight markets’ future growth

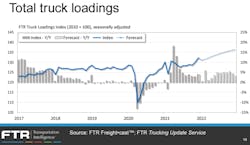

Total truck freight metrics—which the FTR Freight•cast model accounts for contract rates, spot rates, for-hire, and private fleet activity, along with all equipment types—didn’t fully recover to pre-pandemic levels until deeper into 2021. “Over the past few months, though, we’ve seen a significant increase in overall loadings,” Vise said. “Q4 was a very good quarter for goods transport.”

Looking just at spot market metrics, Vise said FTR is “seeing no signs of normalization.” While the spot market is down from May’s record levels, it has held steady the first several weeks of 2022.

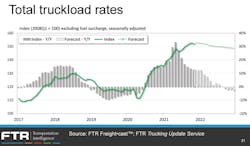

FTR estimates that compared to 2020, total truckload rates went up 19% in 2021—where spot rates jumped 29% and contract rates 14%. FTR estimates the total market volume is divided into 70% contract and 30% spot. “Your mileage may vary,” Vise added. “It does appear that in 2021, the market shifted a bit more toward spot. But we’re still confident that as of today, contract freight still represents the majority of loadings in the market.”

Vise said FTR forecasts total truckload rates to slow down as the year continues before some slight dips by the end of 2022. “We’re looking at spot rates being down by less than 3%, which is not very much when you look at what happened with spot rates not only in 2021 but in the back half of 2020,” he explained. “And we are forecasting contract rates being up 5% to 6%.”

FTR forecasts expect total truck loadings to continue to grow this year, Vise said. “We’re currently running a little bit ahead of 2019 levels. And we’re currently forecasting growth of another 3.8% on top of the gain that we saw last year. So while consumer-oriented segments have been the stars to this point, we actually expect industrial-focused segments to lead the way in 2022. Our longer outlook is to taper back toward normal growth in ’23, ’24.”

Vise noted that if consumer spending slows to more a normal pace this year, it could ease some supply chain problems. That would help the manufacturing sector to improve its output. “There is the potential for even stronger production and associated freight—assuming the semiconductor shortage does not get even worse,” Vise said.

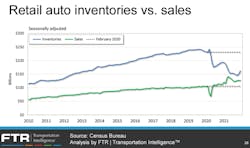

Automakers and chip firms are still differing on when the semiconductor shortage will normalize, with more hopeful opinions pointing to this year. Vise sees more upside for freight because automakers are desparate to replenish inventories this year. “The demand for automotive production is going to be very high,” he said. “Because we're going to need that to replenish inventories—and that's true even if sales do not rise as they build more, which they probably will. This is, I think, a very large upside for freight volume. It’s potentially going to have a significant effect on keeping rates up as well—especially in dry van, where there is a lot of capacity tied to the automotive sector.”

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.