‘Who cares’ if this is a recession? CV demand could prop up market

COLUMBUS, Indiana—If the U.S. economy is falling into a recession, don’t expect it to be like the economic downturns you’ve experienced. Unemployment is down. Americans’ savings accounts are growing. And the trucking industry still needs equipment.

“Are we in a recession? I know everybody is talking about it. But I say, who cares? It’s how you feel right now. It’s really what people are thinking. Perceptions are 9/10ths of reality,” Paul Traub, ACT Research's chief economist, told the crowd of transportation industry leaders gathered in this small Indiana city for the research organization’s 67th seminar.

Traub and fellow ACT Research analyst Jim Meil spent time during ACT’s first entirely in-person seminar since February 2020 to note how the economic conditions of 2022 are different from past U.S. recessions.

See also: Recession? Some factors mitigate downturn

“The 2007 recession was a financial crisis—everybody’s got money now,” Traub noted. “Now, there’s no such thing as a financial crisis. And we’re in a 24/7 news cycle where you’ve got one camp that says everything is falling apart. And the other side is trying to bail water out of the boat, saying: Everything’s just fine, we’ll make it to shore.”

While the political divides are driving consumers’ perceptions, businesses are not as pessimistic, Traub added. He also noted that after a couple of COVID-19 years of spending time—and money—at home, U.S. consumers are busy getting out, boosting the service industry as the consumer good industry lulls.

“There’s some support in the trucking industry for services,” he explained. “People are going to be going out to eat; people are going to be going on vacation; people are going to be doing things which cause consumption of goods.”

Forecasting the future by looking at the past

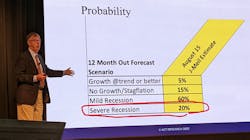

According to Meil’s 12-month outlook, conditions as of Aug. 15 gave a 60% probability of a mild recession. He said there’s a 20% probability of a severe recession. He pinned no growth at 15% and some growth at 5%. “Those are guesses,” Meil noted.

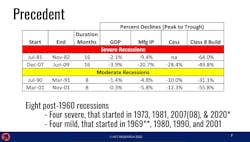

To look into the future, Meil explained the past, which included four severe recessions since 1960. They started in 1973, 1981, 2007/08, and the 2020 COVID-19 recession. The same period saw four mild recessions that began in 1969, 1980, 1990, and 2001.

“Two severe recessions—that occurred 40 years ago (1981) and that Great Recession (2007/08) that we all so vividly remember—they lasted about 16 months,” Meil said. “You see a hit delivered to GDP of 2-4%, manufacturing sector down 10-20% in terms of output.”

Freight metrics also fell during those recessions and Class 8 vehicle builds tumbled 50% to 65%, he added.

Moderate recessions that began in 1990 and 2001 lasted eight months, with smaller GDP and manufacturing reductions. Freight metrics, according to the Cass Freight Index, fell 10% to 12%, and Class 8 builds slowed by 30% to 55%.

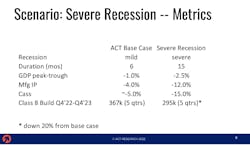

Based on this history, Meil contrasted the best and worst recession cases today. A mild recession would last six to nine months, he said. A severe recession could extend 15 months. These could mean GDP peak-trough falls of 1% to 2.5%, manufacturing reductions between 4% and 12%, and freight metrics sliding 5% to 15%. Class 8 builds from Q4 2022 through Q4 2023 (five total quarters) could range from 367,000 in a mild recession to 295,000 in a severe recession, which would represent a 20% drop.

Fleet demand could make next recession different

Meil said there’s enough fleet demand for equipment that the Class 8 market would have an abnormal reaction to a recession. “The starting point, with regard to pent-up demand, with regard to unsatisfied truck buyers, puts us in a slightly different position as we engage in the next four to six quarters than we were in years like 2007 when going into tough times, we didn’t have the backlogs we have right now,” he explained.

Meil said that ACT Research sees the North American market’s supply-and-demand equilibrium short by 100,000 Class 8 units, which was not the case in previous recession threshold periods. “This time, these circumstances are different,” he said.

Meil said a severe recession would not be a 50-year event. “It’s more like a 20- or 25-year flood,” he said. “They occur with some degree of frequency that is hard to predict and hard to model—in part because we don’t have much of a sample.”

Because these economic conditions don’t happen often, Meil said ACT’s outlook requires some guesswork based on a few instances over the past four decades. “So while it's not the most-likely business planning scenario, it's something that you should wrap your mind around a little bit as we head into it through planning season,” he said.

Traub said he still doesn’t think the U.S. is in a recession. “You can’t really have it with income growing,” he said. “Wages are up. Employment levels are great. That is about a third of the overall criteria for calling it a recession.”

Patrick Manzi, the National Automobile Dealers Association’s chief economist, said he largely agrees with Traub. “But I do think there are probably some consumers out there who feel like they’re in a recession,” he added. “The average household is spending another $460 a month because of inflation. So there are certainly people out there who are feeling pain.”

While inflation might feel like a recession to some consumers, Manzi also said the recent favorable labor market and jobs reports don’t jive with recession conditions. “But as for the future?” he asked. “I think there’s certainly a risk. I would also largely concur with the ACT staff that if it does happen, it would be largely mild.”

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.