A two-week string of diesel price increases has stopped in its tracks as the U.S. average for trucking’s main fuel fell 8.3 cents to $4.539 per gallon this week, according to the newest U.S. Energy Information Administration data.

Averages in all EIA regions of the country also were down for the week of Feb. 6, and the federal data tracker is bullish enough on falling diesel prices that the agency has revised downward—by 25 cents to $4.23 per gallon—its estimate of where the U.S. average will fall for all of 2023. EIA also is estimating that the diesel average will drop further—to $3.70 per gallon—by 2024. Today, the U.S. average still sits 58.8 cents above the level of a year ago, so it has a ways to go to reach EIA's newly revised estimates.

Motor club AAA saw declines in diesel prices coming all week, as its national average dropped every day. AAA tracks the average daily, weekly, and monthly average prices for all 50 states. The motor club had the diesel average down 5.2 cents to $4.624 per gallon for the week on Feb. 6.

See also: Collaborating for a zero-emission future

According to EIA, diesel was down in all regions. And in two regions, the Gulf Coast (down 10.2 cents to $4.249 per gallon) and the Midwest (a 9.6-cent drop to $4.378), the decrease for trucking’s main fuel exceeded the decline in the national average. Diesel dropped exactly as much as the national average—8.3 cents—to $4.539 on the East Coast, where the fuel also was down in every subregion critical to trucking. The fuel dropped 4 cents to $5.086 (the only region above $5 per gallon) on the West Coast, and it was down a fraction of a penny in the Rocky Mountain region to $4.741 per gallon.

EIA revises outlook to reflect lower prices

Meanwhile, EIA’s revised Short-Term Energy Outlook (STEO) portends relief this year and in 2024 after diesel reached multiyear highs in the first half of 2022 that lasted all year. The U.S. diesel average soared to an all-time record of $5.81 per gallon for the week of June 20, 2022, after rising steadily following the market shock and energy market instability brought on by the Russian invasion of Ukraine and the energy-related sanctions against the Russians that followed.

“These forecast price decreases are based on our expectation of lower demand growth for diesel and motor gasoline with continued high production of those products,” according to EIA’s revised STEO, adding that the federal agency "expects limited growth in global demand for gasoline combined with increased gas production and rising inventories as a result in the U.S."

See also: Lessons learned on efficiency: Tales from the road

“Additional refinery capacity that came online in late 2022, combined with additional capacity expansions expected to come online in 2023, also will contribute to rising supplies of both gasoline and diesel fuel internationally, further contributing to lower prices globally in 2023 and 2024,” according to the revised STEO. “We also estimate that U.S. refiners will continue to produce gasoline, even as prices decrease, to meet higher global demand for diesel fuel.”

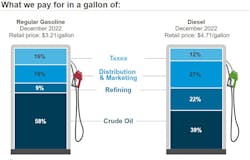

Oil prices also remain an integral part of the diesel and gasoline picture—and key to price declines in each. West Texas Intermediate crude is staying below $75 per barrel, while Brent floats around $80—far below the levels of around $120 per barrel they reached last year.

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.