The recent slide in the U.S. average price for diesel fuel continued this week, reaching the two-month mark and falling another 5.7 cents to $4.128 per gallon for the week of March 27, according to new data from the U.S. Energy Information Administration (EIA). Diesel has dropped almost 50 cents since the end of January.

Trucking's main fuel could be seen declining over the last week in motor club AAA’s daily U.S. average. By March 28, AAA had it down 4.6 cents to $4.238 for the week.

According to the week-of-March 27 data from EIA, diesel is lower than its U.S. average in three regions—down as much as 11.9 cents—critical to trucking operations. Analysts are continuing to say the momentum of the fuel-price slide is being driven by oil prices that have fallen to multiyear lows in the midst of the banking crisis. And others say declining diesel is an indicator of weaker demand and thus a sign of economic danger.

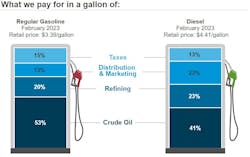

Meanwhile, the U.S. average for gasoline, a fuel used by a lot of work truckers and much more widely by consumers, was flat for the week of March 27, according to EIA, dropping a fraction of a penny to $3.421 per gallon but down 81 cents compared to the level of a year ago.

Regionally, steeper diesel declines

The price picture in EIA’s regions and subregions can form a more complete picture than the U.S. diesel average, though the fuel is now down nationally by more than a dollar—$1.057 per gallon—compared to the year-ago level when different forces, including the Russian invasion of Ukraine, were roiling the markets.

See also: Why diesel still matters

Diesel fell below $4 per gallon in two other EIA regions, the Midwest (where it dropped 4.7 cents to $3.974 per gallon) and Gulf Coast (a 4.8-cent decline to $3.882). The West Coast remains the closest to $5 per gallon, however, but even there diesel fell 5.9 cents to $4.803. The fuel still is above $5 in California, where it nevertheless declined 9.5 cents for the week of March 27 to $5.165 per gallon, according to EIA.

Oil prices lower, demand weakens

Per-barrel prices for crude oil were slightly elevated this week compared to the week of March 20, but West Texas Intermediate still is close to $70, while Brent floated closer to $80 on March 28—both far below their highs of mid-2022.

One analyst reported that the ongoing banking crisis is draining capital from the oil market, depressing futures and crashing prices to multiyear lows, and pushing investors toward precious metals, a traditional safe haven when economic times darken.

See also: Does trucking's future still have ICE in its veins?

Another analyst told Barron’s that dropping diesel prices are in themselves positive for commercial fleets, weary from historically highs last year, but that depressed fuel is a sign that demand is slowing and that the freight economy is weakening. “Diesel fuel is ubiquitous in our economy ... a critical component in industrial production and … supply-chain dynamics,” Brian Milne, product manager, editor, and analyst at DTN, told the financial website.

Weaker demand, he added, is contributing to falling diesel prices, as lower oil prices are. U.S. government data show diesel demand in the first 10 weeks of this year is down 12.6% from the same period last year, Milne reported, with the steep drop due to slowing growth in parts of the economy, especially in heavy industry and construction. This slowdown also is pressured by higher interest rates and the recent bank failures, increasing expectations for a recession, the analyst noted.

“The soft freight market persists as inflation continues to impact consumers’ purchasing power, and recent bank failures and job cuts make recession more likely,” Tim Denoyer, ACT Research VP and senior analyst, added as part of a March 27 update of ACT's For-Hire Trucking Index, which is based on surveys of freight carriers.

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.