Survey: Brokers optimistic about 2024, despite weak freight rates and demand

Demand for freight-hauling still lags, and spot-market rates have stayed well below their 2021 and 2022 performance and even their five-year averages—despite a recent uptick. But brokers remain optimistic about 2024 and said in a recent survey they are optimistic about their prospects over the next six months.

The semi-annual survey, commissioned by media organization Bloomberg and load board Truckstop, sampled 184 freight forwarders, third-party logistics providers and broker agents, and asset and non-asset-based brokers. Most respondents (61%) have up to 50 employees. Broker agents made up the biggest group (34%), followed by non-asset-based brokers (28%) and 3PLs (22%).

See also: High fuel chipping away at shippers’ market

“Despite fewer spot opportunities and moderate economic activity, brokers remain fairly optimistic, with about 61% surveyed expecting demand growth over the next six months,” Lee Klaskow, senior freight transportation and logistics analyst at Bloomberg Intelligence, said in a release from the two organizations that put out the survey. “Freight-broker sentiment is becoming less bleak as spot-rate conditions might be nearing a bottom and an economic soft landing may be achievable.”

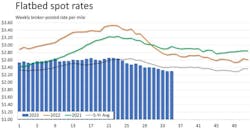

Analysts have been saying the spot market is "at or near bottom" for months, but total spot rates and those for the three major segments of freight-hauling, dry van, refrigerated (reefer), and flatbed, don’t show much sign of sustained improvement, though they’ve experienced a small recent uptick, according to the most recent data provided from Truckstop and industry data aggregator FTR Transportation Intelligence, which together provide Spot Market Insights weekly.

Other data showing similarly shabby monthslong spot-market performance comes to FleetOwner weekly via email from DAT Freight & Analytics.

Hope about the spot market and demand

Despite the spot market’s poor performance, brokers do have a glimmer of hope on demand, according to the survey. About 46% of respondents said volume fell in the first half of 2023 compared with a year earlier, or about 12 percentage points higher than in the Bloomberg/Truckstop survey six months earlier. Though more reported lower demand, the magnitude of declines averaged about 2% compared with last year. About 35% of respondents said first-half-of-2023 volume rose, driven mostly by newer broker businesses gaining share or customer-specific developments, according to the Sept. 6 release.

See also: August trucking jobs fall, reflecting Yellow's demise

In the survey, spot rate sentiment is, like rates themselves, seen bouncing off the bottom: Rates excluding fuel surcharges have fallen 31% since peaking at the end of 2021 and are down 13% from last year’s levels. Brokers have become more optimistic about the outlook, with the drop appearing to be near bottom. About 46% expect spot rates to rise over the next three to six months, 18 percentage points better than the second-half-of-2022 survey, which marked a low in sentiment.

Current spot data shows some encouraging signs

In the latest Spot Market Insights, based on data from the week ended Sept. 1 before Labor Day, FTR and Truckstop report that total broker-posted spot rates (dry van, reefer, and flatbed together) rose less than 2 cents after a smaller half-cent increase the previous week. “Rates were almost 13% below the same 2022 week and more than 5% below the five-year average. Rates have been holding at around 4% to 5% below the prior-year level for the past five weeks, reflecting mainly the spot market’s normalization by August of last year,” according to the week-of-Sept. 1 report, which was posted Sept. 4.

See also: As rates still lag, trucking forecast is cloudy going into 2024

Broker-posted spot rates in the Truckstop system rose modestly during the week ended Sept. 1, resulting in a second straight week-over-week increase for the first time since May. Spot rates also were up for all equipment types for the first time since May 2023.

For the week of Sept. 1, dry van rates rose more than 6 cents, the strongest gain since the end of June, FTR and Truckstop reported. “Rates were nearly 10% below both the same week last year—the least negative [year-over-year] comparison since July 2022—and the five-year average.”

Reefer rates rose more than 3.5 cents after climbing nearly 5 cents during the prior week, according to Spot Market Insights. “Rates, which were up for a third straight week for the first time since November of last year, were nearly 7% below the same 2022 week and about 5% below the five-year average.”

From data for about the same period, DAT in its email to FleetOwner reported load posts on its own network, DAT One, declined 3.2%, while truck posts fell 8.2%. Its van, reefer, and flatbed rates rose 3 cents, 2 cents, and 2 cents, respectively, ahead of Labor Day, though the DAT rates were reported as linehaul rates that don’t include any fuel surcharges or loading and unloading add-ons.

The U.S. truckload market is massive and highly fragmented, so some larger carriers ship freight both under contract and look to fill some of their lanes by seeking shipments on the spot market. However, the spot market’s recent slump, mainly this year, has affected smaller carriers and owner-operators the most. These carriers lean heavily on the spot market, and dry van rates have hovered near only $2 per mile, though refrigerated and flatbed loads generally go for 20 to 50 cents more.

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.