With the fallout of Yellow Corp. and economic uncertainty, 2023 was a challenging year for the trucking industry with mergers and acquisitions. Despite optimistic predictions from experts, M&A activity declined, according to the Tenney Group.

But when looking ahead to 2024, the Tenney Group, a transportation-specialized M&A adviser, predicts a return to normal. But if January is any guide, it will be a busier year for trucking company sales than 2023.

Since the beginning of January, there have been at least five significant acquisitions: Hub Group acquiring Forward Air Final Mile; PS Logistics acquiring Buddy Moore Trucking; Kenco acquiring The Shippers Group; Vanguard Truck Centers acquiring Nacarato Truck Centers; and the most recent acquisition of Cardinal Logistics by Ryder System.

What changed?

To understand why the 2024 outlook is more optimistic, consider why 2023 M&A deals petered out.

During a recent webinar hosted by the Tenney Group and Truckload Carriers Association, CEO Spencer Tenney and CCO Meghan Meurer discussed how 2023 had a shorter supply of sellers than they had seen before. Tenney and Meurer claim this short supply was because of the problems in the freight market, interest rate hikes, and the normalization of record-high equipment values.

See also: Ryder acquires Cardinal Logistics

According to the Tenney Group’s 2024 annual M&A report: “When buyers and sellers reached a meeting of the minds on value and structure, it was extremely challenging to stay aligned through due diligence. Many acquisition targets experienced 20-30% month-over-month performance declines after going under a letter of intent. Consequently, many buyers and sellers paused discussions rather than misuse valuable time and resources on a deal that would never satisfy either party or their boards.”

But with the start of 2024, the freight market is recovering, and other aspects of the economy are more stable. These changes will allow for more sellers in general as the market conditions improve, and buyers and sellers will be able to compromise imore easily on deals, especially if interest rates decrease this year as forecast.

2024 M&A trends

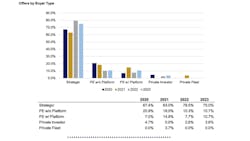

The Tenney Group has two main predictions for 2024: Top buyers will be disciplined, and it expects the most companies entering and exiting the market in 10 years.

According to the Tenney Group’s 2024 annual M&A report: “Cautionary tales of 2023 … will influence the way publicly traded companies, venture capital, and private equity firms approach [transportation and logistics] acquisitions and freight tech investments. They will remain very disciplined when it comes to valuation, and they will prioritize many tuck-in deals that offer limited strategic risk.”

For the past few years, there were too many reasons for companies not to sell, such as Covid-19 and high finances. But the Tenney Group claims 2024 will be the year of the exit, as fatigue and evolving transaction goals push companies to sell.

"We've never had more competition as far as new buyers entering the space," said Tenney during the webinar. "So we think there'll be more buyers, more sellers. And as a result of that, we'll get to the point of valuation alignment much easier."

Other experts agree, including Jonathan Todd, a partner at Benesch Law focused on transportation and logistics. Here's what he had to say about the outlook for mergers and acquisitions in the industry in the Tenney Group's 2024 annual M&A report:

"We are in a 'back to basics' environment where discipline is the name of the game. It is time for a renewed focus on strong business operations. This is the single best way to compete today, even if it is not flashy. Quality operators executing on thoughtful strategic plans will be the winners in organic growth and M&A deals—and it is never too late to improve."

About the Author

Jenna Hume

Digital Editor

Digital Content Specialist Jenna Hume joined FleetOwner in November 2023 and previously worked as a writer in the gaming industry. She has a Bachelor of Fine Arts degree in creative writing from Truman State University and a master of Fine Arts degree in writing from Lindenwood University. She is currently based in Missouri.