Cross-border trucking: Tale of two countries

Mexico. Trucking. Utter those two words together and most U.S. truckers will instantly think of the political football that's been kicked around for years and may yet — someday — allow Mexican motor carriers the same access to U.S. roads that Canadian fleets enjoy under the tri-nation North American Free Trade Agreement (NAFTA).

Since U.S. truckers show little interest in being allowed full access to Mexican roads, when the topic is trucking in Mexico, the talk is about another game altogether. This one is not political, but it is challenging and complex — and demands that motor carriers and logistics providers make a solid, lasting commitment to serve shippers and ensure their own success south of the border.

Managers of U.S.-based operations that have been willing to work long and hard to engage in this lucrative freight market tell Fleet Owner their firms have been and will continue to profit from these efforts.

To be sure, these carriers and logistics providers have invested substantial time, money and effort to develop their cross-border capabilities — no mean feat considering the geopolitical issues and cultural differences involved not to mention the sheer physical distances that must be traveled.

Getting U.S. freight delivered in Mexico is not a market niche for the faint-hearted. That's why once a carrier makes the substantial commitment required to develop business contacts and relationships in Mexico, to hire whatever bilingual staff may be needed, and to invest in freight and trailer tracking technology, etc., it generally takes a long view of its prospects.

One prominent international truckload carrier got its start hauling freight into Mexico almost by accident when it was approached to provide transportation to maquiladora manufacturing plants positioned near the border nearly ten years before NAFTA was even inked. And other name-brand U.S.-based players have been plying these routes as long, if not longer, in one capacity or another.

A fleet owner just thinking of dipping a toe in these waters needs to first grasp that there are essentially two different cross-border freight markets. First, there are the services that revolve around delivering maquiladora freight, including both materials inbound to Mexico and finished goods outbound to the U.S. Second, and arguably the more challenging niche, is delivering U.S.-sourced freight wherever it needs to end up inside of Mexico.

Complicating the picture further is that each U.S. trucking concern operating in Mexico typically fits into one of three operational models: interlining U.S. trailers with Mexican carrier partners that complete deliveries and send freight north; owning one's own Mexico-based carrier to finish deliveries and collect and move freight north to the border; or running with some mix of both.

Even as truckers on both sides of the border ride out the 2008-09 economic tsunami, executives of U.S.-based carriers active in Mexico indicate they fully expect the cross-border freight market to expand anew once recovery is under way.

These players, many of whom have decades of experience working with Mexican carriers, view themselves as well-positioned to leverage future opportunities as the Mexican economy starts growing again and adapts to evolving global trade patterns.

The NAFTA political dustup over which country's trucks can go where has ended up with Mexican carriers limited to a thin commercial zone along the border suitable mainly for drayage operations that bring trailers through Customs. Likewise, U.S. carriers are prohibited from hauling loads straight to destinations in Mexico.

The practical, albeit incredibly inefficient, solution to these restrictions, in effect since NAFTA was inked, is to have trailers loaded with goods transferred between U.S. and Mexican carriers at facilities near major border crossings.

All this trailer jockeying as well as the time it takes to complete each border crossing itself can add from half a day to four days of transit time to a shipment vs. running it straight across the border — and it makes it impossible for customers to know exactly when shipments may arrive.

The only good news in all this for U.S. carriers is that they can drop and pick up their company-owned trailers in the border zone without having to tie their tractors up with border crossing red tape — nor do they have to instruct their drivers on the finer points of driving in Mexico or require them to know any Spanish at all let alone be bilingual.

Carrier and logistics providers that have become adept operating under these rules report profits are to be made, albeit slimmer ones this year. What's more, the very restrictions U.S. cross-border pioneers have learned to adapt to also make it extremely difficult for less sophisticated competitors to make inroads into this lucrative niche market.

Brian Mackowiak, senior vp, operations-Midwest for Penske Logistics, relates how the U.S.-Mexico trucking bridge currently works in practical terms. “Penske Logistics has many U.S. carriers that will partner with Mexico-based carriers to complete deliveries of trans-border shipments inside Mexico,” he explains. “The U.S. carrier will have an interchange agreement with the Mexico-based carrier to take ownership of the U.S. carrier's trailer. There needs to be great collaboration, not only with both the U.S. carriers and Mexico-based carriers, but also with the brokers and dray carriers to make the exchange happen quickly to minimize the delay to our customers.

“Some of our customers contract the Mexican and U.S. carriers separately, typically using a few Mexican carriers to move the freight from the border to the final destination,” Mackowiak continues. “Other customers only contract with the U.S. carrier, and the U.S. carrier uses a partner carrier for the Mexican leg.”

Celadon Transportation has been active in the Mexico market since its founding in 1986 as a contract hauler into the country for Chrysler. Today, Celadon handles Mexico freight with an in-country subsidiary (Servicios de Transportación Jaguar) and via partnerships with numerous independent Mexican carriers.

And despite the buffeting of the economic winds, the carrier is staying the course in Mexico, says founder and CEO Steve Russell. “Of course Mexico has been impacted by the [global] financial crisis,” says Russell. “Freight began to weaken in November and was really a disaster in December, but business has started to come back with June better than May. It may be that it takes several months for the economy to catch up with [the stock market climbing back].”

Russell points out that it's important to understand that well before the worldwide economic meltdown was a dinner-table topic, Mexico's industrial output was already adapting to changing global trade patterns. “Five to ten years ago,” he explains, “Mexico made everything that required cheap labor to be produced. Then China essentially replaced Mexico in that capacity, and Mexico responded by becoming a producer of durable goods.

“And because durable goods [sales] died in January, Mexican exports to the U.S. dropped as well,” says Russell. On top of that, he notes, currency fluctuations have raised prices for U.S. goods. “The end result is U.S.-Mexico trade dropped off significantly — by 30%, according to the U.S. Bureau of Transportation Statistics.”

Given the state of flux the world's economy is in, Russell does not pretend to have the answer to how U.S.-Mexico freight volume will fare. “We can start by asking what impact the Lehman Brothers implosion ultimately will have,” he says. “It hasn't been terrible yet because [governments are] printing money around the globe. But could we see a devaluation of the dollar and the peso go up? [In the end] who knows what will happen next?”

Despite the cloudy picture, Russell offers a cautious stance on the near-term outlook: “We are hopeful but not wildly optimistic about U.S.-Mexico freight [volume] when the economy recovers.”

Penske's Mackowiak is even more bullish on Mexico, contending that “Mexico is emerging in the freight market and will continue to play a significant role for U.S. fleets in Mexico. We do not see a significant volume reduction into or out of Mexico in the longer term.” He says the development of “more joint ventures and operating entities between U.S. and Mexico carriers should help facilitate this type of [freight] growth within Mexico.”

Mackowiak says Penske does caution that with “the open border concept allowing Mexico carriers access to the U.S. currently stalled, there may be a greater pushback from the Mexico side on U.S. fleets operating in Mexico and further tariffs [may be imposed by Mexico on U.S. imports].” On the other hand, he points out that “there are many U.S. companies with fleets in Mexico, which allows them to be successful by working together with Mexico-based operations.”

Con-way Truckload has also been engaged in cross-border trucking since before NAFTA, having started there in 1985 as its predecessor organization, Contract Freighters Inc., points out vp of operations Saul Gonzalez. “Yes,” he remarks, “we have seen many business cycles in this niche since '85. Manufacturing output did shift to China in recent years. But we have heard at least some of that is looking to come back as the [offshore] experience may not have been everything those manufacturers had expected.”

Even with the changes in the Mexican and global economy of late, Gonzalez says Con-way Truckload continues to find the Mexico niche profitable. On top of that, he says the carrier's stateside drivers “like the 1,300- to 1,400-mi. hauls they can get to the border area. Once there, there are terminals and dropyards on this side where they can rest and, yes, many tell me they like the food, too.”

Still, despite the positive overall view, Gonzalez does note that “the devaluation of the peso hurt this year [driving up the cost of U.S. goods in Mexico] and that makes it even more important for us be on top of the balance of freight crossing the border.” He says carriers have to be “light on their feet” to know how to respond with the right amount of trucks at any given time.

“I've been involved in this market since the mid-'80s,” Gonzalez adds. “It all comes down to learning how to put all the pieces in place to ensure a win-win situation for your operation and your Mexican partners. And to do that takes mutual trust and a willingness to understand the cultural differences. That' why we have not only our main office in Joplin, MO, but six in Mexico as well.

“We started there working with Mexican carrier partners and continue to do so,” he notes “We do hold a permit to operate trucks in Mexico, but we feel taking the partner approach is in our best interest, in both the short and long term.”

Gonzalez says the 35 or so partner carriers “operate as another sales agent for us. It's in their best interest, too, to send our trailers back [north] loaded.” On the other hand, he says Con-way has seen competitors buy Mexican carriers to operate and he says “most have not been successful.”

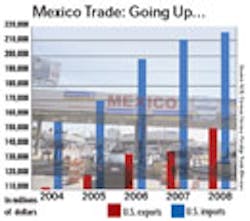

“Schneider has been here in Mexico for 17 years,” says Armando Beltran, director general-Mexico for truckload giant Schneider National, who is based in Mexico. “Over those years, we've seen tremendous change, especially in the rate of trade growth. On Jan. 1, 1994, NAFTA went into effect and during the '90s the rate of growth was in the double digits — and that was maintained through the first half of the '00s.”

He says Schneider began working in Mexico with Mexican carrier partners and continues to do so. “We have gained experience in carrier management and narrowed down the list of those we work with.”

Beltran says these partnerships are crucial as “we know the technologies and systems, but they know the intricacies of the customers, the roads, the drivers, etc., here. We see no material benefit to owning a Mexican carrier ourselves,” he adds.

At the moment, Mexico is experiencing roughly the same drop-off in freight as has the U.S., according to Beltran, who notes that trade has shrunk 30% or more since the global economic meltdown. But, he states, while “the last few years have been tougher, the Mexican economy is projected to grow [past the recession].”

Whether assaying the value of the cross-border trucking niche now or later, Beltran suggests keeping in mind that while “Mexico has been a significant trading partner with the U.S. along with Canada and China, in the long term China and Mexico will become the two largest. And Mexico has long been tightly tied to both the U.S. and Canadian economies. It's very important to understand this close economic coupling of the three countries.

“Free trade is in the best interests of everyone,” Beltran adds. “And truckers will continue to find the most efficient way to bring goods to consumers on both sides of the border.”