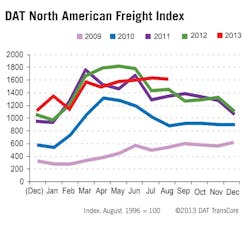

DAT: Spot-market freight robust through summer

The latest North American Freight Index prepared by DAT, a unit of TransCore, shows that spot- market freight volumes climbed by 0.4% in August compared to July. According to DAT, while freight typically peaks on the spot market in June, this year “robust volumes continued through the entire summer… and extends into Spetember.”

Month-over-month, load availability increased for two segments: 3.1% for van trailers and 3.8% for reefer trailers.

Meanwhile, flatbed-load availability saw a “typical seasonal decline of 5.1%.

As for rates on the spot market, those for vans remained stable in August and thus “in line with seasonal norms.”

However, rates dropped 3.0% for reefers and 1.8% for flatbeds.

On a year-over-year basis, freight availability increased 13% for the month.

Van freight volume climbed 10% while reefer loads soared 22% and flatbed freight jumped 14% -- compared to August 2012.

Year over year, van rates went up 2.3% and reefer rates rose 1.9%.

But flatbed rates declined 4.6%, which DAT said was notable as compared to the “unusually high rates of August 2012.”

Reference rates for the Index are derived from DAT’s RateView. The company noted that the rates are cited for linehaul only, excluding fuel surcharges. According to DAT, those rates rose in August on a month-over-month basis, but declined compared to August 2012.

The monthly DAT North American Freight Index reflects spot-market freight availability on the TransCore DAT network of load boards in the U.S. and Canada.

DAT is a leading freight marketplace platform and information provider. Through its solutions, DAT Load Boards, TruckersEdge, and DAT RateView, the said it hosts over 90-million spot load and truck listings and compiles $20 billion of transacted shipment data annually.