I wasn’t familiar with Overhaul, another recently launched attempt to leverage technology to cut out the middle man in the supply chain, when I stopped by their booth. But I did recognize the co-founder and CEO, Barry Conlon. He’s the supply chain security expert that grew FreightWatch International into, arguably, the leading brand in logistics security. Having sold FreightWatch to United Technologies Corp., Conlon explained to me that he had the time, and a little capital, for a new venture—and Overhaul was born.

But don’t assume that Overhaul is just another spin on the “uberization” of trucking, he’s quick to point out.

“The industry is far more complex, nuanced than the Uber model,” Conlon says. “Anyone who says they’re going to create a technology that will suit the shipper’s needs or an owner-operator’s needs, they really don’t understand the industry.”

That’s an interesting pitch, since the Overhaul system sure looks a lot like a virtual broker that connects loads with freelance capacity. But that’s where the nuance—and Conlon’s connections in the shipping community—come into play.

The distinctive selling point for Overhaul is that Conlon aims to introduce a new market to spot freight load matching. High-value freight shippers, he contends, “would never put their product online.”

More to the point, high-value shippers aren’t looking for the cheapest rate. The cost of poor service is just too high. But that’s not to say these shippers don’t care about what they pay—their business just isn’t the kind that can go to the lowest bidder.

The point of Overhaul, then, is to connect these premium shippers to demonstrably trustworthy owner-operators, with Overhaul taking a small transaction fee rather than a typical broker’s percentage and the balance going to the carrier. The system will be a “meritocracy” in which truckers build their credibility and, more importantly, in which they are rewarded for jobs well done.

Indeed, when Overhaul opens for business this summer, Conlon anticipates that some truckers will find themselves at a familiar loading dock. The difference, with Overhaul, is that the load will have been contracted directly with the shipper, and the owner-op will see a 25-30% increase in his net-net share, according to Conlon.

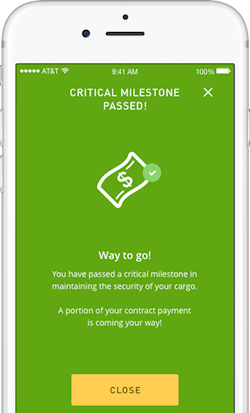

The cornerstone of the Overhaul system is accountability: Truckers will be required to log “milestones,” or intermediate steps as part of each delivery. Essentially, this is Conlon’s way of guaranteeing shippers that best practices in supply chain security are understood and applied by Overhaul’s pool of carriers. The good news for truckers is these milestones come with financial incentives. And, Conlon explains, a portion of the contract will be paid en route, and the balance within seven days. Overhaul will charge no factor fees for this quick payment, he emphasized.

“Our guys will be earning more than Wal-Mart drivers—I am absolutely guaranteeing that,” Conlon says. “Trust is a two-way street. If an owner-op comes onto my platform, I’m going to ask him to jump through some pretty low hoops. Nothing I’m asking him to do is onerous—it’s all simplistic stuff. But it resonates trust to the buyer.”

Can a company actually make money “advocating on behalf of the driver”?

The proof will be in the freight: If Conlon can actually come through with a new class of customer for load matching, Overhaul might well be a nice fit for some the “best of the best” independents. We’ll see.

Get the details at over-haul.com.

About the Author

Kevin Jones

Editor

Kevin has served as editor-in-chief of Trailer/Body Builders magazine since 2017—just the third editor in the magazine’s 60 years. He is also editorial director for Endeavor Business Media’s Commercial Vehicle group, which includes FleetOwner, Bulk Transporter, Refrigerated Transporter, American Trucker, and Fleet Maintenance magazines and websites.

Working from Beaufort, S.C., Kevin has covered trucking and manufacturing for nearly 20 years. His writing and commentary about the trucking industry and, previously, business and government, has been recognized with numerous state, regional, and national journalism awards.