Key takeaways:

- Truck sales are plummeting due to tariffs, impacting small businesses, though small carriers stay hopeful.

- Analysts predict a slow recovery for the supply chain, even if a trade deal is reached, which may lead to disruptions.

- Class 8 tractor orders have decreased significantly, reaching their lowest level since May 2020, highlighting industry challenges.

Today, tariffs are slowing truck sales to milestone lows and paralyzing major businesses. Logistics firms are already feeling impacts, while small businesses see an existential threat in tariffs. However, most small carriers are optimistic about freight’s future.

In the very near future, analysts expect tariffs to slow port traffic and push down for-hire trucking rates.

“Even if they do reach a trade deal in Switzerland this weekend, it’s still going to take months” for the supply chain to recover, Dean Croke, principal analyst for DAT Freight & Analytics, told FleetOwner.

Suddenly reactivating the supply chain would lead to major disruptions to capacity and volume demands, reminiscent of the pandemic. Unfortunately, a quick end to the trade war is still the ideal outcome.

“That would be the best thing that could happen,” Croke said. “If it doesn’t [end this weekend], then I think the outcome is much more severe.”

See also: Live updates: How Trump’s tariffs are shaping trucking today

Class 8 demand plummets

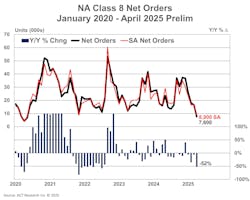

Class 8 tractor orders have dropped significantly. Both ACT Research and FTR Transportation Intelligence found that truck sales in April were the lowest since May 2020.

ACT Research’s preliminary truck sale data for April found equipment orders fell significantly both month over month and year over year. The firm estimated 7,600 Class 8 unit orders: a 52% decline year over year.

The firm noted that April showed the weakest medium-duty and heavy-duty order tally since the beginning of the pandemic. April nears the end of the industry’s annual order season, but when seasonally adjusted, ACT found that the order count was still low.

FTR Transportation Intelligence found a similar plummet in equipment orders: Class 8 orders fell 54% both month over month and year over year to just 7,400 units. FTR’s seven-year average for orders in April was 18,963.

“In addition to slowing economic and truck freight market growth, prolonged tariff-driven cost increases and, potentially, regulatory changes could further suppress near-term demand within the Class 8 segment,” Dan Moyer, senior analyst of commercial vehicles for FTR, said. “This will very likely reduce industry volumes, complicate production planning, and negatively affect profitability and stability for OEMs and suppliers in the North American Class 8 truck market.”

Spot market doing 'pretty well'

The economic disruptions have somewhat boosted the truckload spot market, Croke observed. Tariff chaos has opened new lanes, suppliers, and unexpected volume surges.

“The spot market has been doing pretty well,” Croke said.

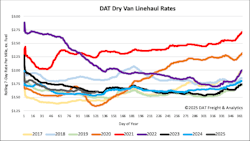

In its reports on last week’s spot market, DAT found that loads declined week over week across all three major equipment types while rates mostly ticked up.

Dry van load posts on DAT one fell 3.3%, refrigerated loads fell 11.8%, and flatbed loads fell 1.4%.

Refrigerated loads would typically increase during that week, but instead declined due in part to a slow start to produce season. Flatbed volumes last week were up 18% year over year but 8% lower than the week’s long-term average.

Average dry van linehaul rates increased by a penny to $1.62 per mile, up 6 cents from last year. Refrigerated rates averaged $1.92 per mile, up 2 cents from the previous week and 1 cent from last year. Flatbed rates remained flat at $2.16 per mile, still 16 cents higher than the previous year.

Produce season will still bump up demand and rates for dry van and reefer loads, particularly out of California. However, headwinds might reduce those gains, Croke suggested. A late start to produce season, economic uncertainty, added capacity from drayage slowdowns, and declining exports are pushing against the product season gain.

“I think rates won’t spike this year; it’ll be more like a speed bump,” Croke said. “Normally, we see, April 15 to July 4, a 20 to 25 cents-per-mile rate lift. This year, it’ll be about half that in the refrigerated market. Not horrible, but not great—and not the sort of year that carriers would normally want.”

Port freight traffic to slow down

The major consequences of tariff policy are approaching: Port freight movement is likely to slow down in May.

The nation’s imports appear to be dropping. TD Cowen analysts reported a steep drop in shipping volumes during a critical import season across both the East and West coasts.

The Los Angeles port said that it expects a 10% drop in all imports in the second half of the year. Nearly half of the port’s shipment traffic comes from China: The port predicts a 35% drop in cargo imported from Asia.

See also: How well are you prepared for International Roadcheck 2025?

U.S. exports to the world are also facing challenges. According to CNBC, Vizion found that container export bookings declined since March for almost every U.S. port.

“Nearly all of U.S. exports have taken a hit,” Ben Tracy, VP of strategic business development at Vizion, said.

Yet, year-over-year export comparisons are still strong, the firm observed. In a recent report, Vizion said that container export bookings from January through April 28 were mostly positive year over year, with nearly half of the observed weeks showing more than 10% annual growth in bookings. The firm’s measure of container bookings for U.S. exports to China, however, declined more than 70% year over year in recent weeks.

China recently made some of its biggest U.S. order cancellations since 2020, halting orders for 12,000 tons of pork, 6,400 tons of wood pulp and paperboard, and more.

Drayage capacity could enter truckload market

The port slowdown would likely impact local drayage carriers.

"The fact that no more ships are going to come in with loads and also those ships are not taking out any loads, that means that there will be no work for us to do and that will definitely affect us economically," said a local drayage truck driver according to NBC Los Angeles.

Those Class 8 tractors may find other work in truckload freight, according to Croke.

“If you’re out of work as a drayage carrier in Los Angeles, and you’ve got a long-haul capable truck, where do you go to look for work?” Croke asked rhetorically.

Excess capacity has been a persistent problem for truckload rates since disruptions from the pandemic. At the beginning of the year, analysts predicted capacity would become less of a problem—but sudden changes to truck driver employment could change things.

The shift in capacity is already happening, Croke said: “I had a carrier confirm this week, where that excess capacity on the dray side is now going to go to other markets to try and find work. What we’re thinking about is an oversupply of capacity and more downward pressure on rates—out of California in particular.”

An increase in capacity, while freight volumes will soon weaken substantially, could lower the load-to-truck ratio for many segments, weakening carriers’ pricing power.

“Shippers are probably still the big winners here,” Croke said. “They were looking at low, single-digit rate increases throughout the course of this year, but they’re probably more optimistic now about being able to keep rates even lower.”

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.