Trucking capacity reached a bottom; 2026 just needs better freight demand

Key takeaways

- Carrier numbers and employment have declined significantly over the past three years.

- Capacity is now near its lowest point, giving carriers a pricing advantage if freight demand increases.

- A modest freight demand boost is expected midyear 2026, which could lead to higher utilization and rates.

Hopes for a freight rate recovery in 2025 were dashed; expectations for moderate freight growth never materialized. Will 2026 be any better?

“Ultimately, it [2025] was kind of a lost year.” Avery Vise, VP of trucking for FTR Transportation Intelligence, told FleetOwner. “Looking ahead to 2026 … I think it puts the trucking industry arguably in an even stronger position for recovery because capacity has tightened even further.”

The for-hire overcapacity problem may no longer be the major problem facing the industry. Measures of capacity have fallen significantly for several years in a row. Now, the industry needs a boost in freight demand—which has few promising signs.

How for-hire capacity fell to near bottom

The overall number of carriers in the U.S. has declined quite a bit over the last three years. From December 2022 to December 2025, the Federal Motor Carrier Safety Administration's (FMCSA’s) count of property carriers with operating authority fell by 11.4%.

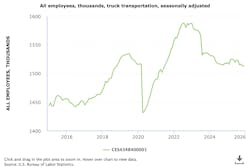

Truck transportation employment also decreased. According to the Bureau of Labor Statistics' estimate of truck transportation employees (CES4348400001) for that same period, trucking employment fell by 4.7%.

A popular suggestion in the industry is that FMCSA’s driver qualifications crackdown solved the overcapacity problem—but that isn’t exactly right, according to Vise:

“I think a lot of people want to attribute the decline in capacity to English language and non-domiciled CDLs. I don’t think that would be accurate,” Vise said. “I do think an accurate way of saying it is that it improved it …. It clearly added to it. But did it fundamentally change where the industry was heading? I don’t think so. We were heading in that direction anyway.”

English language violations exploded in the second half of 2025 following Trump’s executive order on English proficiency enforcement. In 2023 and 2024 combined, FMCSA recorded exactly 14 driver out-of-service (OOS) violations due to a driver’s lack of English proficiency. In 2025, the agency recorded 12,308 OOS violations.

If there were 3.58 million truck drivers in 2024, the enforcement initiative likely removed about 0.6% of the driver workforce so far. FTR estimates that, if the OOS violation data is annualized, the English proficiency crackdown would take about 25,000 drivers off the road in a year.

However, the trend of declining carrier populations and truck employment began well before the second Trump administration and has impacted much more than 0.6% of carrier capacity.

What does the market need for higher rates in 2026?

For 2026, it looks like for-hire carrier capacity won’t fall much further.

“Capacity for truckload carriers has come down quite a bit and, in fact, probably almost as deep as it can without the loss of a lot of carriers,” Vise said. “From an attrition standpoint, trucking companies largely have gotten to about as tight as they can get.”

With capacity near its bottom, shippers with new freight demands will have a much lower chance of finding underutilized carriers willing to accept hauls at low rates. However, that only gives carriers a pricing advantage if freight demand rises.

“As the year progresses, we would expect that any strengthening in freight demand will turn into stronger utilization and stronger rates,” Vise said. “The question is, when are we going to get that increase in freight demand?”

FTR’s forecast predicts that a seasonally adjusted boost in freight demand won’t arrive until the middle of the year—and that the midyear bump would be modest. Many sectors’ key metrics for gauging freight demand, such as consumption and manufacturing, remain mostly flat.

“The last two years or so have been about bringing capacity back in line with the sluggish freight market. By and large, trucking has done that—but it can’t get to a sustained recovery just on the capacity side of the ledger. There has to be sustained growth in freight volume, and that volume has got to come from either manufacturing, or consumption, or both," Vise said. "But something has to go up, and at this point it’s not really happening. Consumption is holding steady and manufacturing is, at best, holding steady.”

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.