Spot truckload rates gained traction during the first week of March as load-to-truck ratios increased for all three equipment types, said DAT Solutions, which operates the industry’s largest load board network. Retailers are playing a role as they replenish inventories of shelf-stable food, cleaning supplies, and other goods as consumers respond to the COVID-19 coronavirus.

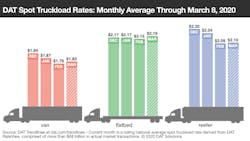

National average spot rates, March (through March 8):

- Van: $1.82 per mile, up 3 cents compared to February

- Refrigerated: $2.11 per mile, up 2 cents

- Flatbed: $2.19 per mile, up 5 cents

Van trends: The National Retail Federation is forecasting retail imports to be 18% lower in March and 3% lower in April year over year before bouncing back with 9% increases in May and June. That means some sort of normalcy should return to trade by the end of March or early April unless conditions shift dramatically. For now, demand for truckload services is trending up seasonally.

The national average van load-to-truck ratio increased for the sixth straight week, rising from 2.1 to 2.4 last week. A handful of high-volume lanes had rates rise in both directions, including Dallas to Houston, which jumped 9 cents to $2.09 per mile, while Houston to Dallas gained 4 cents to $1.93. Elsewhere, rates are uneven:

- Dallas to Laredo, Texas, fell 7 cents to $1.18 per mile; Laredo to Dallas held steady at $2.09.

- Stockton, Calif., to Salt Lake City fell 9 cents to $2.05 per mile; Salt Lake City to Stockton lost 4 cents to $1.47.

- Buffalo to Charlotte fell 6 cents to $1.80 per mile; Charlotte to Buffalo dropped 4 cents to $2.16 per mile.

Reefer trends: The national average refrigerated load-to-truck ratio inched up to 4.6 last week compared to 4.2 the week before. That’s low for carriers seeking pricing power.

But produce markets are in a seasonal transition with geography coming into play. Border markets in Texas and Arizona are seeing an influx of imports from Mexico, and shippers there are looking for trucks:

- Tucson, Ariz., to Los Angeles hit $2.45 per mile, up 23 cents

- McAllen, Texas, to Atlanta rocketed up 10 cents to $2.35 per mile

- McAllen to Elizabeth, N.J., gained 4 cents to $2.15 per mile

The situation is different in south Florida. Miami to Atlanta rates lost 15 cents to $1.52 per mile, and Miami to Elizabeth fell 6 cents to $1.64.

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director