Spot van rate up 12% since March 1; Load-to-truck ratio jumps

With supply chains strained by the impact of the COVID-19, spot truckload rates were higher for all three equipment types during the week ending March 22, said DAT Solutions, which operates the industry’s largest load board network.

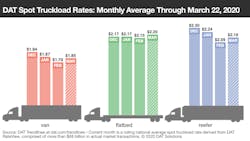

National average spot rates, March (through March 22):

- Van: $1.85 per mile, up 3 cents from last week and 6 cents higher than the February average

- Refrigerated: $2.16 per mile, up 5 cents from last week and 7 cents higher than February

- Flatbed: $2.20 per mile, unchanged from last week, and up 5 cents compared to February

Van trends:

Rates up 12%: The average spot van rate increased on 88 of the 100 highest-volume lanes on DAT load boards compared to the previous week. The line-haul van rate (no fuel surcharge), which entered the month below last year’s average, has increased 12% from $1.51 per mile on March 1 to $1.70 per mile on March 23.

Demand for trucks is rising: The national average van load-to-truck ratio last week was 3.5, up from 3.2 the previous week. That’s the eighth straight week of rising ratios. More dramatically, the average ratio has more than doubled (up 150%) since the same week in 2019.

Mid-range hauls are paying better: Any overnight stay for the driver involves safe parking, decent food, and other roadside necessities that are in short supply right now. Shippers are paying more for van capacity on “tweener” lanes with lengths of haul in the 250- to 600-mile range. Examples:

- Memphis to Chicago averaged $2.06 per mile, up 25 cents; Chicago to Memphis added 10 cents to $1.93

- Atlanta to Columbus, Ohio, averaged $1.78 per mile, up 19 cents; Columbus to Atlanta rose 8 cents to $2.06

- Columbus to Memphis averaged $1.75 per mile, up 14 cents; Memphis to Columbus gained 8 cents to $2.16

- Dallas to Houston averaged $2.42 per mile, up 19 cents; Houston to Dallas rose 3 cents to $2.03

Reefer trends: The average spot rate increased on 66 of the 72 highest-volume reefer lanes DAT tracks.

Supply chain shifts: Large-scale shutdowns of schools, restaurants, and other food service venues have focused shippers’ and carriers’ attention almost entirely on retail grocery outlets, including e-commerce. Further, reefers must be loaded “live” with perishable goods, making delays and disruptions even more costly.

More pressure coming: In the coming weeks, a new layer of demand will be added to the mix when spring produce harvests begin. Expect reefer rates to remain elevated from now through the end of June.

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director