After surging in March, spot truckload freight volume drops 39%

After several weeks with trucks in high demand, truckload freight volumes dropped abruptly during the week ending April 4, said DAT Solutions, which operates the industry’s largest load board network.

The number of posted loads fell 39% compared to the previous week.

At the same time, load-searching volume skyrocketed. The number of posted trucks on the spot market increased 13% week over week, the largest such gain in available capacity so far this year.

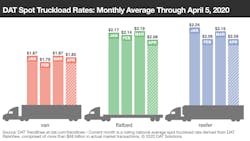

National average rates, March:

- Van: $1.87 per mile, 8 cents higher than the February average

- Reefer: $2.19 per mile, up 10 cents compared to February

- Flatbed: $2.19 per mile, up 4 cents compared to February

Rates declined from their March averages during the first week of April. From April 1-4, the average van rate was $1.85; the reefer rate was $2.09; and the flatbed rate was $2.08.

Key trends

Reefer rates retreat: Reefer rates have given back a good portion of their March gains, and it seems more likely that reefer rates will slip below year-ago levels in the next seven to 10 days until the typical seasonal uptick toward the beginning of May.

Load-to-truck ratios slide: The national average van load-to-truck ratio was 1.5 last week, down from 2.8 the previous week. The national average reefer load-to-truck ratio fell to 2.6 from 4.9, another sign that pricing power has shifted toward shippers.

Borderline decline: There’s still plenty of reefer freight to be found in the Mexican border markets of McAllen, Texas, and Tucson, Ariz., but average rates trended down last week:

- McAllen to Atlanta lost 22 cents to $2.45, and lane rates also dropped from McAllen to Dallas, Chicago, and northern New Jersey.

- Tucson to Los Angeles fell 19 cents to $2.44, but that rate is higher than it was three weeks ago. Rates also dipped on lanes from Tucson to New York and from Tucson to Chicago.

Produce picking up: Reefer rates were higher on lanes originating in the Midwest and California, plus a few lanes out of Florida:

- Chicago to Kansas City rocketed up 23 cents to $2.60 per loaded mile.

- Green Bay, Wis., to Minneapolis added 13 cents to $2.51.

- Stockton, Calif., to Portland, Ore., increased 16 cents to $3.09 (other Stockton lanes rose, too).

- Lakeland, Fla., to Baltimore rose 9 cents to $2.12.

- Los Angeles to Phoenix was up 11 cents to $2.97.

"Thank you to the owner-operators, drivers, fleet managers, freight brokers, and warehouse workers who keep the freight flowing. Be well, stay safe," DAT said.

About the Author

FleetOwner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Josh Fisher, Editor-in-Chief

Jade Brasher, Senior Editor

Jeremy Wolfe, Editor

Jenna Hume, Digital Editor

Eric Van Egeren, Art Director