Improving traffic on the country’s busiest lanes for truckload freight helped push spot rates higher in the days leading up to Memorial Day, said DAT Solutions, which operates the industry’s largest network of load boards.

The number of posted loads actually dropped 16.5% during the week ending May 24, which includes the Friday, Saturday, and Sunday of Memorial Day weekend, but truck posts fell 29%. Shippers and brokers paid a premium to secure capacity ahead of the holiday.

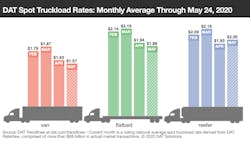

National average spot rates through May 24:

- Van: $1.57 per mile, 6 cents lower than the April average

- Flatbed: $1.88 a mile, 6 cents lower than April

- Reefer: $2.00 a mile, 7 cents higher than April

The rolling national average van, flatbed, and reefer rates were 6, 7, and 8 cents higher, respectively, on May 24 than they were on May 1. Rates are low but trending in the right direction.

Key trends:

Load-to-truck ratios are building: The load-to-truck ratio is the number of loads available relative to the number of posted trucks. Like a barometer, it indicates how much pressure there is on rates to go up or down.

- Van: 2.0 loads per truck. That’s low for late May but it’s up from 1.7 last week

- Flatbed: 14.3, up from 11.2 last week. It was just 4.4 five weeks ago

- Reefer: 3.1, up from 2.9

Rates are inching higher: Where ratios move, prices tend to follow. With contract carriers taking capacity out of the spot market, rates were higher on 73 of DAT’s top 100 van lanes by volume compared to the previous week, and volumes were up 5.7% on those 100 lanes. Rates were better on 49 of the top 72 reefer lanes by volume.

Fewer blank sailings: Container volume into West Coast ports is down 15% to 20% compared to last year but there are fewer blank or cancelled sailings compared to earlier this year. The Port of Long Beach reported that in the first quarter of 2020, there were 61 blank sailings to the ports of Long Beach and Los Angeles; 48 are expected for this quarter.

The Southwest stays hot: The average Los Angeles outbound van rate increased 9% week-over-week to $2.20 per mile. That’s up from $1.83 two weeks ago. Several key outbound lanes are up since the start of month:

- Los Angeles-Stockton, Calif.: $2.49 a mile, up 30 cents from May 1

- Los Angeles-Dallas: $1.84 per mile, up 40 cents from May 1

- Los Angeles-Phoenix: $2.76 per mile, up 49 cents from May 1

A few California-based reefer lanes broke $3 per mile last week, including L.A.-Phoenix at $3.07. Reefer rates are rising elsewhere in the Southwest, including out of Nogales, Ariz.:

- Nogales-Dallas: $2.56 a mile, up 28 cents compared to the previous week

- Nogales-Chicago: $2.58 a mile, up 25 cents

- Nogales-Brooklyn: $2.58 a mile on a 2,500-mile trip

Florida peaks: Major outbound reefer lanes in Florida posted declines last week, including from Miami to Atlanta (down 16 cents to an average of $1.87 per mile) and Elizabeth, N.J. (14 cents lower to $2.08).

About the Author

FleetOwner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Josh Fisher, Editor-in-Chief

Jade Brasher, Senior Editor

Jeremy Wolfe, Editor

Jenna Hume, Digital Editor

Eric Van Egeren, Art Director