Spot truckload rates rise amid supply chain imbalances

Spot truckload freight rates increased again last week, bucking typical trends for late July, according to DAT Solutions, which operates DAT One, the industry’s largest load board network.

The number of spot dry van, refrigerated, and flatbed loads on DAT One decreased 3% during the week ending July 26 while the number of trucks posted increased 2%. Spot rates, which usually taper off during July, have been elevated as shippers and freight brokers turn to the spot market to help them manage imbalances in their supply chains.

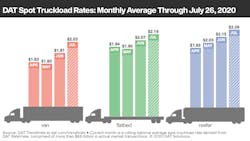

National average spot rates for July

- Van: $2.03 per mile, up 22 cents compared to June

- Flatbed: $2.19 per mile, up 12 cents

- Reefer: $2.29 per mile, up 14 cents

These rates are rolling averages for the month through July 26. They include a fuel surcharge.

National average month-to-date line-haul rates (excluding a fuel surcharge) increased 1 cent for vans and flatbeds at $1.83 and $1.95 per mile, respectively, compared to the previous week. The average spot reefer line-haul rate was unchanged at $2.07.

Trends to watch

Spot line-haul van rates are above 2018 levels: The national average spot line-haul van rate (excluding fuel surcharges) reached $1.88 per mile last week, equal to the same week in 2018 when capacity was considerably tighter. Load posts on DAT One were roughly 30% higher year over year as a result of shippers utilizing the spot market more due to pandemic-related disruptions.

DAT’s Ratecast forecasting model expects dry van rates to plateau through the end of August, although there is upward pressure due to continued freight imbalances, uneven surges in demand for certain commodities, and overall supply chain dislocation.

Retail lanes are busy: Average spot van rates were higher on 50 of DAT’s top 100 lanes by volume compared to the previous week and pricing increased on several key lanes:

- Memphis to Atlanta: $3.01 per mile, up 45 cents

- Houston to Oklahoma City: $2.55 per mile, up 19 cents

- Stockton, Calif., to Salt Lake City: $3.16 per mile, up 12 cents

DAT’s Market Conditions Index (MCI) shows average rates moving higher in larger retail freight hubs including Ontario, Calif., a bellwether for truckload activity given its proximity to the ports in Los Angeles. Following a surge in imports in June, spot van loads out of Ontario were up 4% week over week and increased for the fourth week in a row as freight moved to warehouse hubs such as Phoenix, Dallas, and Stockton.

Produce imports arrive in the East: Volumes increased on half of DAT One’s top 72 reefer lanes. East Coast import markets, including Philadelphia and Elizabeth, N.J., were up a combined 6% week-over-week and 29% month-over-month as produce from the southern hemisphere arrives by sea. Harrisburg, Atlanta, Boston, Lakeland, Fla., and Miami were the top five destinations for reefer freight from Philadelphia and Elizabeth last week and reefer spot rates out of both markets were strongest in the 300-mile length of haul range.

DIY and home construction boosts flatbed volume: Flatbed freight volumes are expected to remain high based on data from the U.S. Department of Commerce, which reported a 17% increase in new home construction in June. Expect ongoing demand to haul standard framing dimension softwood lumber as wholesalers and distributors look to stock depleted inventories.