“By ending the lockdown, I think we did the right thing and we got the economy growing again,” said Dr. Jeffrey Rosensweig, director of the John Robson Program in Business, Public Policy & Government at Goizueta Business School of Emory University.

Rosensweig, provided insights on economic trends affecting the heavy-duty commercial vehicle manufacturing market during “A Global Economic Outlook” presentation at the Heavy Duty Dialogue 2020 virtual fall meeting this week.

In March and April this year, lockdowns initiated at the state and federal levels in response to the COVID-19 pandemic created a significant slowdown in the economy. Since states began reopening in late April, economic activity started to increase, but at a slower pace than the sharp decline seen in the second quarter. Instead of the common "V" shaped economy swings, the decline and subsequent recovery pattern is more like that of a checkmark, or “Nike swoosh” design, noted Rosensweig.

Unemployment and layoffs

Rosensweig advised a lockdown and subsequent slowdown of the economy helped to control the initial onset of COVID-19 cases in the U.S. He attributed the continued economic recovery with the efforts to get and keep the COVID-19 outbreak under control. He acknowledged this has been aided by continued adherence to health guidelines such as wearing masks and following social distance guidelines.

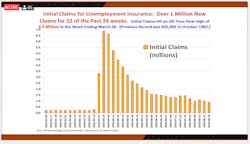

“The growth isn't that fast, but it's steady and it's been pretty strong, as we've seen in the job numbers, and the amount of jobs being created month after month. But we can never forget 22 million jobs were lost in March and particularly in April," Rosensweig said. “It will take us awhile to cover back that turf, but we are halfway back.”

Keeping the economy open will be the only way to ensure the continued upward trend in economic growth, he added.

At its peak in late April, 7 million unemployment claims had been submitted per week, far above the average 300,000 claims before the pandemic.

“The bad news is, a million people are getting laid off a week so we do need to look for continued growth,” Rosensweig noted. “And, the last thing we probably need now is a is a further lockdown.”

Another challenge many businesses faced is the additional temporary federal unemployment insurance relief payment of $600 issued by the federal government through the CARES Act. State governments already provide a weekly stipend for unemployment insurance for those who qualify – about $400 per week on average, said Rosensweig. With a total combined insurance benefit averaging $1,000 per week, this provided a disincentive for many to go back to work.

GDP forecasts

Gross domestic product (GDP) represents the value of goods and services produced in a given country, providing an indicator of the health of the country’s economy.

While many national economies have seen a loss in GDP compared to the previous year, China has an estimated a 2% increase expected in 2020. Rosensweig equated this to the strict and swift lockdown measures China implemented in the first quarter, after which the country opened back up and began producing goods.

The U.S. has seen just more than a 5% drop in GDP compared to 2019. Forecasts indicate a growth of 3% for 2021.

“Even at the end of 2021, we won't be quite back where we were right before the pandemic,” said Rosensweig. “Maybe by middle of 2022.”

Looking to the future, forecasts indicate China will continue to have a lower GDP on average, compared to the recent previous years of double-digit growth. Rosensweig equates this to the “demographic drag” expected.

“China is aging rather dramatically, and their labor force is actually shrinking,” he said. “In the medium to longer term, India is potentially more relevant because their labor force is growing.”

Rosensweig suggested potential manufacturing business opportunities may expand in not only India, but other Southeast Asian countries such as Indonesia, Vietnam and Thailand.

Manufacturing trends and challenges

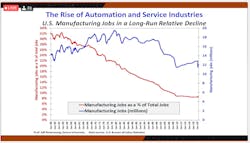

In 1979, the U.S. reached a peak 20 million manufacturing jobs. Since that time, the number of jobs in manufacturing has decreased to 12 million.

“A lot of people think all the production went to China, it really didn't,” Rosensweig said. “There are estimates that more than 80% of that loss in jobs – from the close to 20 million to 12 million – are due to our increased productivity, to our automation (technology), the fact that we can produce more with less workers.” He added that only about 15% of manufacturing jobs have been lost to offshoring jobs to other countries.

Robotics and automation have helped to drive the productivity of manufacturing processes in the U.S. As advancements in these technologies continue through improvements to machine learning and artificial intelligence, this will further drive production efficiencies, noted Rosensweig.

As the U.S. develops more high-tech jobs, manufacturing jobs continue to decline. At its height, manufacturing jobs made up one third of jobs in the U.S. Today, only 8% of U.S. jobs are in manufacturing.

One area that will continue to cause challenges is the supply chain, in part due to trade tensions and tariffs.

Even when countries do have manufacturing production managed in the U.S., many still rely on intermediate products supplied from global companies to build into their products. Long-term, if trade tensions continue, U.S. manufacturers could solve these challenges by partnering with U.S. suppliers when possible.

“Whenever you have protectionism, other countries do retaliation, and some of that is hurting us,” Rosenweig said, regarding the trade war and tariffs enacted by other countries like China. “It's actually hurting our manufacturing because even though some jobs are coming back that we're producing in the U.S. instead of importing, it's really hurting our manufacturing exports.”

Looking to the future

According to Rosensweig, one area that has assisted with the economic rebound has been the aggressive nature of the Federal Reserve through reducing the federal interest rate near 0%, and buying bonds. As it relates to buying bonds, the Fed bought back not only treasury bonds that help the federal government finance the deficit, but also mortgage bonds and corporate bonds to support companies challenged in the wake of the COVID-19 pandemic.

“The worry, of course, is if the Federal Reserve is printing a lot of money, will that lead to inflation? My forecast is it won't, even for a couple of years, because our economy still has a way to go," Rosensweig noted. "We don't have an excess demand for goods where firms would be raising their prices because they've got so much demand for them. Also, we still have a lot of people who are underemployed. They're not going to start demanding wage increases, which could cause inflation for quite a while; they just want a good job.”

Looking toward the future, as the recovery continues, Rosensweig advised that controlling government spending will be imperative.

“We've had a huge increase in government debt,” he said, adding that the U.S. went from $22 trillion to $26 trillion in debt since the beginning of the pandemic. "The government had no choice, but we can't let this continue after the pandemic.”

The uncertainty of what may happen with the upcoming presidential election still looms. But, regardless of the outcome, Rosensweig believes a recovery is happening currently and will continue.

“My own forecast is the economy is growing, and will keep growing, but it won't be a ‘V,’” Rosensweig suggested. “Don't make your plans as if the economy's about to go bonkers and go wild. But steady growth for the next few years will bring things back without causing inflation. And, that may be the best situation of all, which is an economy that grows more steadily.”

About the Author

Erica Schueller

Editorial Director | Commercial Vehicle Group

Erica Schueller is a former editorial director of the Endeavor Commercial Vehicle Group.