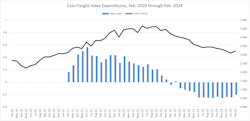

Freight volumes and expenditures showed promising signs of recovery this February after months of consistent year-over-year decreases, according to the latest freight index from Cass Information Systems.

In the February issue of the Cass Freight Index, shipment volumes increased 7.3% over January. This was slightly ahead of month-over-month seasonal expectations of 2.0% but was down 4.5% year over year. The 4.5% difference is the index’s smallest year-over-year decline in 10 months, noted Tim Denoyer, VP and senior analyst at ACT Research, in the Cass Transportation Index Report. The shrinkage in annual declines is an encouraging sign that the market is recovering.

See also: Will the freight economy warm up in spring?

The expenditures component of the index, which measures the total amount spent on freight, fell 19.8% year over year in February. These expenditures were up 4.0% month over month, or 1.8% when seasonally adjusted.

According to Cass, the total amount spent on freight has been down year over year consistently since February 2023. However, like shipments, February’s measured expenditure is the smallest year-over-year decrease in nine months. Before 2023, freight expenditure was consistently up year over year from September 2020 through November 2022.

A freight market forecast

Where Cass gets this data

The Cass Freight Index uses data from invoices and spending processed by Cass on behalf of its client base. The data covers 36 million invoices and $38 million in spend from hundreds of large shippers dealing in packaged goods, food, automotive, chemical, medical/pharma, retail, heavy equipment, and more. Truckload freight represents more than half of the dollars spent, followed by less than truckload, rail, parcel, and so on.

The Cass Transportation Index Report is a monthly analysis and commentary of the Cass Freight Index, Cass Truckload Linehaul Index, and the freight market generally.

In conjunction with the monthly Cass Transportation Index Report, ACT Research publishes its Freight Forecast to look at the near future of freight.

Freight carriers have faced a long low point in their market’s cycle, punctuated by low rates and increasing operational costs. When will the market begin to recover, and how quickly?

Denoyer’s report suggests that shipments are likely to rise soon, but the bottom of the market cycle might endure a while longer. In terms of freight volume, he expects shipments to decrease only 1% year over year in March and to turn positive year over year in May.

Continued low rates are pushing carriers to exit the industry. This thinning freight capacity generally leads to a recovery in freight rates. On the other hand, however, demand for Class 8 equipment remains strong. According to Denoyer’s report, these capacity additions could further lengthen the bottom of the freight cycle.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.