DAT: Spot freight volume surges 7.4%

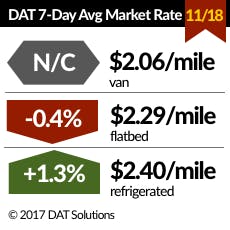

The number of loads posted on the spot truckload market jumped 7.4% during the week ending Nov. 18 and the number of trucks posted was virtually unchanged, reported DAT Solutions, which operates the DAT network of load boards. Van and refrigerated load-to-truck ratios increased by 15% and 13% respectively and spot rates were above seasonal norms as national averages:

- Van: $2.06/mile, unchanged compared to the previous week

- Flatbed: $2.29/mile, down 1 cent but atypically high for the season

- Reefer: $2.40/mile, up 3 cents to a three-year high

Amid strong pre-holiday volumes and concerns about the impact of ELDs on capacity, rates have been buoyed by the rising price of diesel fuel, which was $2.91/gallon as a national average last week. Spot truckload rates incorporate a surcharge for fuel.

In the van freight market, load posts increased 13% and truck posts declined 1% last week. At 6.7, the load-to-truck ratio for vans is just below the peak of 7.0 experienced at the end of September and is more than twice as high as it was last year at this time.

Los Angeles, where the average outbound rate gained 12 cents to $2.69/mile, was again the No. 1 market for van load volume. Volumes and rates also increased in Memphis ($2.38/mile, up 6 cents), Houston ($1.72/mile, up 2 cents); and Chicago $2.73/mile, up 2 cents).

The number of available spot reefer loads increased 15% and a 2% gain in truck posts helped send the reefer load-to-truck ratio up to 13.0 loads per truck. California markets have been exceptionally strong for outbound freight, led by Sacramento ($2.91/mile, up 26 cents). The Midwest is also hot, with Chicago at $3.35/mile (up 8 cents) and Grand Rapids at $3.56/mile (up 2 cents).

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. RateView's comprehensive database is comprised of more than $33 billion in freight bills in over 65,000 lanes. All reported rates include fuel surcharges. For the latest spot market load availability and rate information, visit dat.com/industry-trends/trendlines and join the conversation on Twitter with @LoadBoards.