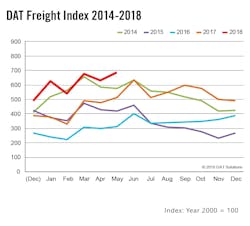

Demand for spot market truckload shipments reached new heights in May, according to the DAT North American Freight Index. Seasonal shipments, along with rising fuel costs, pushed freight rates higher in May, with dry van and refrigerated rates hitting their highest levels since January, and flatbed rates setting a new record.

Spring produce shipments along the southern tier of states contributed to a 9% uptick in spot market volumes, a common trend from April to May. Volumes were 34% higher than in May 2017, according to the Freight Index, with much of that increase due to a 69% spike in flatbed volumes year over year.

According to DAT, Flatbed demand has been unprecedented this year, bolstered by increased activity in the energy and construction sectors, and compounded by the tighter hours-of-service limitations that have affected every trucking segment since the implementation of the electronic logging device mandate.

As a result, flatbed rates have set new records. The national average flatbed rate for May was $2.73 per mile, an 8-cent increase over the April average and an all-time high. The national flatbed rate was 63 cents higher than in May 2017, which included a 14-cent increase in the average fuel surcharge from a year ago.

The peak shipping season out of Florida helped push the average reefer rate to $2.52 per mile, 10 cents higher than the previous month’s average and 50 cents higher than last year. Spring harvests contributed to tighter truckload capacity for dry van freight as well, which pushed the average van rate up to $2.16 per mile in May. That rate was 1 cent higher than the April average and a 47-cent increase from May 2017.

“Seasonal demand kept truckload capacity tight across the southern half of the country,” said DAT industry analyst Mark Montague. “We can expect the high volumes and strong market conditions to keep rates elevated through June and beyond.”

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director