Truckers posted 5.2% fewer trucks during the week ending Saturday, Aug. 25, which helped pump the brakes on a recent downward trend in spot truckload rates, according to DAT Solutions, which operates the DAT network of load boards.

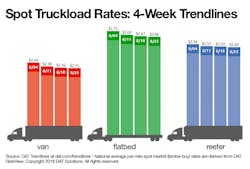

The number of available loads increased 3.7%. The national average van, flatbed, and reefer rate fell 1 cent to $2.15/mile, $2.66/mile, and $2.49/mile, respectively.

Van trends: The number of van load posts on DAT load boards edged up 2% while truck posts dropped 6%, pushing the national van load-to-truck ratio up to 7.1 loads per truck.

While national van rates have slipped in August, the 100 most active van lanes on DAT load boards are showing signs of recovery. Forty-five lanes were up in pricing, 46 lanes down, and 9 were neutral.

The most notable lane among the gainers: Chicago to Allentown, PA, rose 15 cents to $3.04/mile. One year ago that lane was in the $2.25 to $2.75 range.

It's a good example of the new-normal rate-level reset.

Van markets in Texas and the Southeast region are slipping, and nowhere has the trend been more evident than in Houston ($1.95/mile, down 6 cents). A slowdown in energy-related freight may be part of the story; also, one year after Hurricane Harvey hit the region, much of the recovery and rebuilding is complete.

Reefer trends: Reefer load posts on DAT load boards jumped 10% compared to the previous week. Truck posts fell by 5%, which pushed the load-to-truck ratio up to 9.6 loads per truck.

The run-up to Labor Day weekend and the new school year typically leads to a surge in demand for transportation of fresh food. This year, the back-to-school grocery fest coincides with late-summer harvests: apples, pears, onions, and potatoes are rolling out of orchards and fields in the Upper Midwest, Pacific Northwest, and parts of the Northeast.

Flatbed trends: After 10 weeks of declines, the national flatbed load-to-truck ratio edged up 3% last week to 28.2 loads per truck. Load posts were up 1% while truck posts dipped 2%. More lanes rose than fell last week in the top 78 flatbed lanes, and overall rates continued to slip but at a slower rate.

All four of the top-gaining flatbed lanes were from Roanoke, VA, an indication of activity through East Coast ports.

DAT Trendlines is generated using DAT RateView, a service that provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends.

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director