Severe weather in Asia and the U.S. Eastern seaboard slowed seasonal freight flows in October, leading to truckload transportation delays at U.S. ports, according to DAT Solutions, which operates the DAT Freight Index, a measure of load posting volume on the DAT network of load boards.

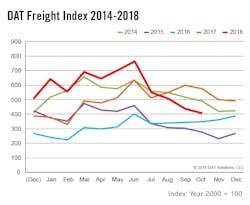

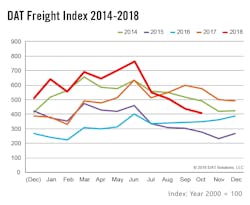

As a result, spot market freight availability hit a low point for the year in October. October volume was 7% lower month over month, and 33% below October 2017 levels.

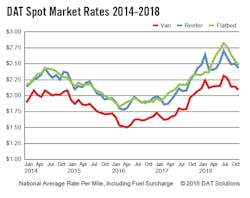

Truckload freight rates also slipped lower for all equipment types, compared to September. Rates remain well above 2017 levels, however, due partly to an increase in fuel surcharges that compensate for rising diesel costs.

“We expected a seasonal rebound in October but it was interrupted by Hurricanes Florence and Michael in the Southeastern U.S., as well as Typhoon Mangkhut in Hong Kong,” said Peggy Dorf, DAT market analyst. “Some of that demand for truckload capacity has shifted into early November, with imported goods moving from seaports to regional distribution centers across the country.”

The DAT Freight Index reflects load posting volume on the DAT network of load boards, and 100 on the Index represents the average monthly volume in the year 2000. Additional trends and analysis are available at DAT Trendlines (dat.com/trendlines). Referenced rates are the averages by equipment type, based on $57 billion of actual transactions, as recorded in DAT RateView. Rates per mile include fuel surcharges, but not accessorials or other fees.

DAT operates the largest truckload freight marketplace in North America. Transportation brokers, carriers, news organizations and industry analysts rely on DAT for market trends and data insights derived from 279 million freight matches (2018 estimate) and a database of $57 billion in annual market transactions. Related services include a comprehensive directory of companies with business history, credit, safety, insurance and company reviews; broker transportation management software; authority, fuel tax, mileage, vehicle licensing, and registration services; and carrier onboarding.

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director