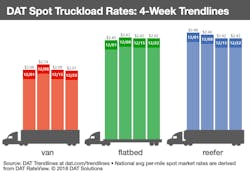

The number of load posts on the spot truckload freight market fell 5% while truck posts declined 6% during the week ending Dec. 22, according to DAT Solutions, which operates the DAT network of load boards.

As a result, spot rates were stable and roughly in line with the same period last year. National average van and flatbed load-to-truck ratios declined slightly while the reefer ratio increased compared to the previous week, reflecting demand to move fresh produce and temperature-controlled goods ahead of the Christmas holiday.

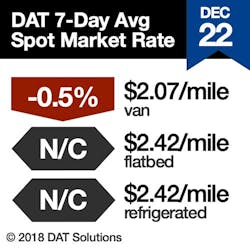

Van trends: The national average van load-to-truck ratio edged down from 5.2 to 5.1, while the average spot van rate was a penny lower at $2.07/mile. The number of van load posts fell 7% compared to the previous week while truck posts declined 6%.

Overall, the van market reflected stability. Among the top 100 van lanes, the number of losers and gainers was balanced and freight schedules showed no obvious signs of stress from e-commerce demands this year.

Regionally, Houston pricing caught up to a recent spike in volumes as the average outbound rate rose 5 cents to $1.84/mile. The average outbound rate from Dallas increased 2 cents to $1.76/mile, led in part by the Dallas-Houston lane, up 9 cents to an average of $2.48/mile.

Prices were weaker out of Seattle, Philadelphia, and Denver—markets known for low spot van rates. Indeed, Denver-outbound tumbled 4 cents to an average of $1.36/mile last week.

Reefer trends: The national average reefer rate was unchanged at $2.42/mile. The number of reefer load posts was up 6% while truck posts dropped 6%, which helped elevate rates on high-volume lanes and push the reefer load-to-truck up 12% to 7.1.

Reefer rates from McAllen, Texas, continue to reflect strong demand. Winter harvest activity helped boost the average outbound rate 15 cents to $2.38/mile; higher-priced lanes included McAllen to Elizabeth, N.J., which surged 51 cents to $2.75/mile, and McAllen to Atlanta, up 25 cents to $2.51/mile. Dallas-Houston was the region’s high lane for reefer freight, gaining 8 cents to $2.91/mile compared to the previous week.

DAT Trendlines are generated using DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $57 billion in freight payments.

DAT load boards average 1 million load posts per business day.

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director