Spot truckload pricing shows signs of bottoming out

Spot truckload freight pricing held firm during the week ending August 25 despite a 3% drop in the number of posted loads, said DAT Solutions, which operates the industry’s largest network of load boards. The number of posted trucks increased 2.6% compared to the previous week.

Pricing was virtually unchanged week over week, a sign that spot rates have hit a seasonal low prior to Labor Day, when demand typically starts to build again.

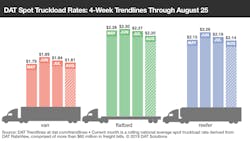

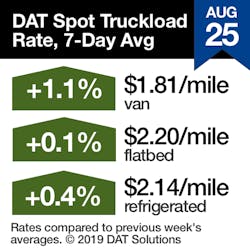

National average spot rates, through Aug. 25:

- Van: $1.81 per mile, 3 cents lower than the July average

- Flatbed: $2.20 per mile, 7 cents lower than July

- Reefer: $2.14 per mile, 5 cents lower than July

Van trends: Van volume on DAT’s 100 top van lanes was up 3% last week but pricing changes were muted: 44 lanes were higher, 47 were lower, and nine were neutral compared to the previous week, with no dramatic swings either way. The rate from Columbus to Buffalo was the biggest gain last week while the biggest drop was the return trip from Buffalo to Columbus:

- Buffalo to Columbus: $1.85 per mile, down 10 cents

- Columbus to Buffalo: $2.82 per mile, up 13 cents

The national average van load-to-truck ratio fell from 2.4 to 2.2.

Reefer trends: Late summer fruit and vegetable harvests in the Midwest and California have not made up for markets where production has struggled due to weather. The national average reefer load-to-truck ratio fell from 4.7 to 4.4 and rates were higher on just 24 of DAT’s 72 high-traffic lanes.

Demand for trucks was heaviest in California, where the number of available loads was up in Los Angeles (9%), Fresno (8%), and Ontario (6%). Rates in these markets were softer compared to the previous week, however.

Key takeaways:

- Reefer markets have been waiting for an uplift from late summer fruit and vegetable harvests but so far that hasn’t happened. Of the few reefer lanes that saw higher rates last week, the biggest increases were on relatively low volumes of spot freight.

- The threat of new tariffs, plus the effect of disappointing harvests pushing reefer capacity onto the van market, have helped keep van rates in check this summer.

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director