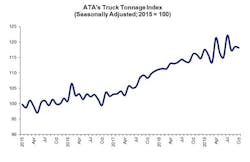

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index declined 0.3% in October after rising 1% in September. In October, the index equaled 118.1 (2015=100) compared with 118.5 in September.

“October’s tonnage change, both sequentially and year-over-year, fits with an economic outlook for more moderate growth in the fourth quarter,” explained ATA chief economist Bob Costello. “The ongoing slowdown in manufacturing activity also weighed on truck tonnage last month.”

It is important to note that ATA’s tonnage data is dominated by contract freight, which is performing significantly better than the plunge in spot market freight this year.

September’s reading was revised up compared with October.

Compared with October 2018, the SA index increased 1.7%, the smallest year-over-year gain since June. The index is up 3.9% year-to-date compared with the same period last year.

The not seasonally adjusted index, which represents the change in tonnage hauled by the fleets before any seasonal adjustment, equaled 125.4 in October which is 8.4% above the September level (115.7). In calculating the index, 100 represents 2015.

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director