Freight volumes are improving but rates are expected to remain soft due to a mixed pricing environment and seasonally slow equipment orders heading into the fourth quarter, according to recent market analysis from multiple firms.

Here's a look at the latest rate and equipment data, along with predictions for the rest of 2023 from DAT, FTR, and ACT Research.

Freight rates

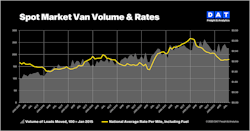

DAT Freight and Analytics released its numbers for spot market volumes and rates. DAT reported increases from July with van up 8%, reefer up 4%, and flatbed up 9% from the month before. Load-to-truck ratios also strengthened with the van ratio up 0.2, from 2.6 in July to 2.8 in August. The reefer ratio was up from 3.8 in July to 4.4 in August; however, the flatbed ratio was down from 7.1 in July to 6 in August.

See also: DAT: Freight volumes bounce back in August

Spot rate and line-haul rates saw some movement from July to August, DAT reported, which resulted from carrier negotiations due to rising fuel expenses. The spot van rate was up 2 cents compared to July to $2.09 per mile. The reefer rate rose 7 cents to $2.51 per mile. Finally, the flatbed rate dropped 3 cents to $2.54 per mile. Line-haul van rates were down 6 cents from July to $1.57 per mile in August, while reefer rates were down 2 cents from July to $1.94 per mile, and flatbed rates decreased by a dime to $3.19 per mile.

DAT also reported that van contract rates did not change from July to August. However, the contract reefer rate increased by 8 cents to $2.99 per mile from July to August, and the contract flatbed rate decreased by 10 cents to $3.19 per mile.

“At 48 cents, the gap between our benchmark spot and contract van rates was the least it’s been since April 2022,” said Ken Adamo, DAT chief of analytics. “We expect the pricing difference to narrow further, with contract rates falling over the next 12 months and spot rates increasing. In the near term, the fourth quarter will be a busy time for freight. It’s important to come into the months ahead armed with pricing data and strategies you trust.”

Truckstop and FTR Transportation Intelligence posted data that broker-posted spot rates showed a “modest cooling” for all equipment types the week of Sept. 15. This was the largest decline in spot rates since mid-July. Refrigerated rates led the decline, with a decrease of 2 cents, reported by DAT, and dry van returned a chunk of its rate gains over the previous six weeks. The flatbed rate decrease also represented a downward trend after gains in the two weeks prior.

The following week, total load activity declined 5.1% after the previous week’s rebound, reported up to nearly 18% by FTR and 7.3% reported by DAT. FTR reported these numbers reflect almost 28% below the five-year average for the week, and DAT’s numbers reflect 35% lower than the same week last year. The ratio of loads to trucks—the Market Demand Index—fell to its lowest level in four weeks. Dry van spot rates declined by 2 cents, and dry van loads declined 4.8%. Refrigerated spot rates decreased 3.5 cents, and loads fell 11.5% from the previous week to almost 30% below the five-year average for the week. Flatbed rates increased 1.5 cents from the lows of the week prior, and flatbed loads decreased by 4.7%, nearly 36% below the five-year average for the week.

Although rates are still running below the five-year average, they are not showing any significant deterioration in that comparison, suggesting that the market is operating normally, according to DAT.

See also: FTR: Shipper environment ‘moderately favorable’ in May

Market outlook

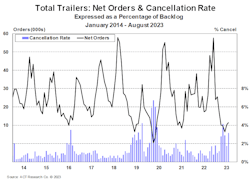

ACT released its monthly “Freight Forecast,” “State of the Industry: U.S. Trailers,” and “State of the Industry: NA Classes 5-8” reports for September and predicts the freight market to “remain soft” due to the expansion of private fleets, trailer sales seeing a slump that’s typical for the season, and equipment demand to fade toward the end of the year.

With trailers, production outpaced orders in August, dropping trailer backlogs to 14%, said Jennifer McNealy, ACT Research’s director of CV market research and publications. The number of fleet orders canceled in August rose 3.2% over July.

See also: Outlook for trailer builds in 2024 more bullish, ACT says

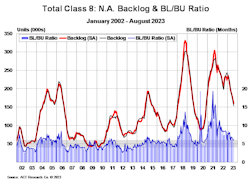

Like trailer orders, ACT reported “strong build rates” and “weak order volumes for Class 8 units,” resulting in an improved Class 8 backlog that decreased by 11,000 to 152,600 units. According to ACT, this is the lowest nominal backlog-to-build ratio since fall 2020 at 5.3 months. However, ACT President and Senior Analyst Kenny Vieth stated this improved backlog is “likely to turn higher” soon as 2024 order season begins.

As for Classes 5-7, the backlog fell 3,100 units to 113,900 units in August. Due to a lower daily build rate in August, the backlog-to-build ratio rose from 4.7 in July to 5.3 months in August.

“While the tractor market appears under pressure heading into 2024 amid weak freight and falling carrier profits, vocational truck demand remains strong,” Vieth explained. “August saw net orders up 3,900 units m/m to 19,500 units, with vocational trucks accounting for 42% of orders in August, well above the historical average around 29%.”

Finally, ACT predicts a soft freight market for the remainder of the year.

“We’ve created a proxy for private fleet activity that suggests mid-single-digit growth in freight volumes, helping to explain the difference between the accelerating U.S. economy and declining for-hire volumes,” shared Tim Denoyer, VP and senior analyst at ACT Research. “Private fleet growth is evident as Class 8 tractor retail sales are on pace to set a record this year, yet for-hire fleets are by and large demonstrating capital discipline.”

See also: As rates still lag, trucking forecast is cloudy going into 2024

Although the freight market is near the bottom of the cycle, ACT researchers believe that the new truck orders expected in the coming months will set the market tone for next year, Denoyer continued. However, “this improving outlook could be spoiled if fleet expansion continues ahead of industry need.”

About the Author

Jade Brasher

Senior Editor Jade Brasher has covered vocational trucking and fleets since 2018. A graduate of The University of Alabama with a degree in journalism, Jade enjoys telling stories about the people behind the wheel and the intricate processes of the ever-evolving trucking industry.