As 2012 comes to a close, what better time is there to analyze factors affecting fleet operations for years to come?

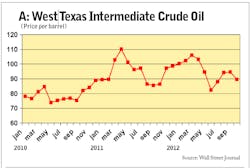

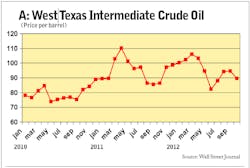

Crude oil prices, and therefore diesel fuel prices, will remain volatile for the foreseeable future since crude oil has become a financial asset to many, just like stocks, bonds and currencies.

Ultra-loose monetary policy that depresses returns on government securities is causing investors to seek riskier investments, such as crude oil, to increase yields. That has resulted in investor sentiment playing a role in determining crude oil prices. Oil supply and demand factors change relatively slowly in comparison to investor sentiment, so crude oil prices are much more volatile today than before the financial crisis.

The European sovereign debt crisis will continue to play a large, albeit indirect, role in influencing crude prices (Chart A) in 2013. When investors feel more confident about the future, they invest in riskier assets. This will be true again if they believe that European governments are handling the sovereign debt crisis. In the short term, this debt crisis will play a large role in determining investor sentiment in 2013.

Governments at all levels are not collecting enough revenues to meet the needs of maintaining a depreciating infrastructure. The Federal Highway Trust Fund has been operating in the red for the past several years and with the federal budget deficit at unsustainable levels, the government can no longer afford to shift funds from the general budget to cover the shortfall. Vehicle operators will pay higher taxes, permits and fees as a result in the future. Governments will form public-private partnerships to expand or maintain the infrastructure, but this does not imply stable fees in the future. Investors seek returns on their investments.

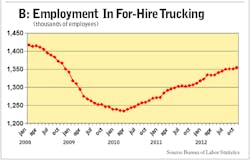

The supply of available drivers (Chart B) will become acute again in the future when freight growth expands to rates requiring fleets to expand capacity. Driver shortages are a function of supply and demand. The supply of drivers has not reached crisis level since fleet capacity has remained relatively stable because of sluggish to moderate freight growth during the recovery. This will not be the case indefinitely. Demographics are changing the makeup of the U.S. labor force, and carriers must reach beyond their traditional labor pools for drivers. This will require different recruiting and retention techniques and probably changes in vehicle specs as well.

In the medium term, diesel will remain the dominant fuel powering the truck population. Fuels, however, will become fragmented in the future as the CNG/LNG distribution and propane autogas networks expand. With crude oil at high prices, there is an incentive to develop alternative fuel supplies, including methane derived from landfills and biofuels. In addition to high crude oil prices, government regulations are increasing the cost of fuels derived from petroleum. Economics and technical innovation will result in the expansion of alternative fuels.

Suppliers will adjust to business changes, and companies that fail to change will likely fail themselves.

About the Author

Chris Brady

Founder of Commercial Motor Vehicle Consulting and former FleetOwner contributor.