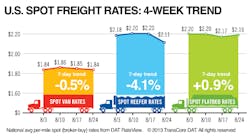

Seasonal declines in spot market demand and capacity for refrigerated and dry-van freight were recorded by the DAT Network of load boards for the week ending August 24, resulting in a drop in rates for both of those trucking segments.

National average reefer rates tumbled 9 cents to $2.11 per mile, DAT said, while van rates dipped 1 cent to $1.84 per mile. By contrast, the average flatbed line haul rate increased 2 cents to $2.19 per mile. DAT reiterated that all of those rates include carrier fuel surcharges.

Van markets

Among the 13 top markets for spot van freight, only three posted gains in per-mile outbound rates. Los Angeles gained 2 cents to $2.12 per mile, the only market in the West to post an increase in the average rate. Chicago and Columbus each added about 2 cents over the previous week to $2.08 and $1.91 per mile, respectively.

On the other hand, Philadelphia, Memphis, Charlotte, Atlanta, Houston, and Dallas all declined compared to the previous week.

Van freight availability slid 2.4% for the week while van capacity went the other way, up 1.9%. The load-to-truck ratio decreased 4.3%, from 2.7 to 2.6 as a national average. Load-to-truck ratios represent the number of loads posted for every truck posted on the DAT network of load boards.

Reefer markets

With summer harvests wrapping up, the average spot market rate for refrigerated freight slid 9 cents to $2.11 per mile. In the West, rates rose in just three major reefer markets: Sacramento, Denver, and Twin Falls.

Rates fell hard in agricultural markets in southern California, Phoenix, and Green Bay (down 8 cents to $2.24 per mile). McAllen, Texas, remained at $1.78 per mile for a second week, but the number of loads in the area took a big hit.

Reefer load availability ticked up a half percent while capacity increased 4.3%. The load to truck ratio for reefers decreased 3.7% to 8.0, down from 8.3 during the prior week.

Flatbed markets

Flatbed freight availability dropped another 3.5% last week while capacity flattened. The load-to-truck ratio dropped 3.7% for the week, from 16.6 to 16.0, DAT reported, with the reasons for the decline including a lull in construction as well as declining traffic at East Coast ports.

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director