Hot December: Freight volume and rates trending up

Winter may have arrived a little early for most of the country this month, but the spot-freight market has kept right on “simmering” in December, according to DAT, whose services include trucking information analytics and a freight marketplace.

During the week ending December 14th, per DAT Trendlines, a composite of the firm’s network of load boards, spot-freight load volumes increased for dry vans, reefers and flatbeds.

In the van market, spot loads jumped a whopping 20% while the average rate remained a seasonally high $1.94 per mile (including fuel).

That performance amounts to 6 cents higher than the national average van rate in November.

DAT advised that “with most holiday retail goods already through the supply chain, the rate may be attributed in part to businesses trying to take advantage of favorable pricing on commodities prior to 2014.”

Viewed regionally, activity from most major truckload freight hubs remained “firm”:

- Outbound rates from Buffalo increased 3 cents to $1.95 per mile

- Rates from Charlotte were up 9 cents to $2.26 per mile

- Rates from Houston increased 3 cents to $1.53 per mile

- Rates from Chicago rose 3 cents to $2.14 per mile

On the other hand, Los Angeles outbound rates slipped 4 cents to $2.11 per mile.

Nationally, the number of available dry-van loads on DAT load boards climbed 18.7% that week. Since van capacity increased 7.3%, the load-to-truck ratio went up 10.6% to 3.7— raising it from 3.3 the previous week. DAT noted that load-to-truck ratios represent the number of loads posted for every truck posted on its network of load boards.

Both flatbeds and reefers realized significant gains as well.

DAT said the national average flatbed rate gained 2 cents (1%) last week.

Nationally, demand for flatbed loads rose 21.4%-- and that was after increasing 17.8% the prior week.

And flatbed capacity “rebounded” 16.1%, pushing the load-to-truck ratio up 4.6% to 13.9.

Among the strongest flatbed lanes regionally was Harrisburg, PA, which climbed 26 cents to $3.41 per mile.

The national average refrigerated-freight rate rose 3 cents to $2.13 per mile.

Available loads for reefers increased 18.8% over the prior week, while reefer capacity increased 4.3%. And that pushed the load-to-truck ratio up 13.9% to 11.0 last week, up from 9.6.

“The current freight surge seems to be mostly business-related, at least for the last four to six weeks,” remarked DAT analyst Mark Montague. “Industrial production is trending up, and there is a sense among business buyers that commodity prices will rise significantly in the new year.”

“When raw material costs rise,” he continued. “There comes a tipping point when it makes sense to stock up, because the inventory carrying cost will be lower than the coming cost increase.”

As Montague sees it, 2013 has been “a most unusual year.” He pointed out that it started with a “spike” in freight availability in January.

“The market was lackluster in the spring, and we had the usual build-up of freight in June,” Montague observed. “Then the freight volume and rates never really fell off, not in July as expected, and not in the entire second half of the year.”

As it happens, DAT is not the only data tracking-and-crunching firm that’s currently painting the freight demand and rate environment as bullish.

Earlier this week, Eric Starks, president of FTR Associates, said during the most recent Truck & Trailer Outlook webinar presented by the research and forecasting firm that, in general, freight volumes are “moving in a positive direction.

“The freight environment is relatively healthy and in some cases, very strong,” he emphasized.

Making his case, Starks reviewed truck-tonnage bogies from multiple sources, relating that:

- The American Trucking Assn.’s (ATA) Truck Tonnage index is up 8% YoY

- FTR’s Loadings is up 6.3% this year

- ATA’s Loading Index (NSA) is up 5.2%

- The Cass Freight Index (includes non-trucking modes) is reading -2.0%

“It’s a mixed [freight] picture, but the bulk of the items are suggesting healthy tonnage,” he pointed out.

Starks also said that freight rates have been “trending up” in six months since the revised Hours-of-Service (HOS) rules went into effect. He added that freight rates are expected to rise right through next year.

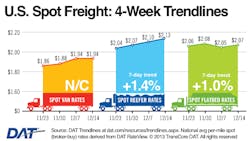

Editor’s Note: The DAT chart accompanying this report depicts national average spot market (“broker buy”) rates during the past four weeks. The rates are derived from DAT’s RateView as well as from the company’s network of load boards.

For a complete DAT national and regional report on spot rates and freight demand, click here.