2013 in the rearview: Of rates and rates of return

Early data on trucking for the tail end of 2013 presents a mixed bag.

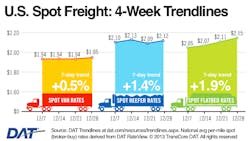

On the one hand, spot-freight rates and capacity demand ended December on the strong side.

On another, truckload carriers report being pessimistic about rates—even as a rising number of them advise they are now realizing “adequate” rates of return.

Despite freight activity falling off with Christmas falling on a Wednesday, spot truckload rates across all equipment types rose during the week ending Dec. 28, according to DAT, whose services include trucking information analytics and a freight marketplace.

The week that ended astride two holidays saw the average spot rate for van freight go up 1 cent to $1.95 per mile (including fuel), according to DAT Trendlines, a composite of the DAT network of load boards. That showing was seven cents higher than the average rate seen in November.

Regionally, DAT found that most major truckload van-freight hubs were strong during the holiday week:

- The average rate out of Chicago increased 6 cents to $2.25 per mile

- Dallas went up 6 cents to $1.71 per mile

- Atlanta rose 4 cents to $1.96 per mile

- Memphis jumped 10 cents to $2.34

- Philadelphia soared 14 cents to $1.88 per mile.

- And in the West, Los Angeles managed a 1-cent increase to $2.14 per mile— marking “one bright spot among the region’s major markets.”

Nationally, the number of available dry-van loads fell 47.8%. And capacity diminished as well, dropping 33.8%.

That performance pushed the load-to-truck ratio down 21.2% to 3.3%-- compared to 4.2 the prior week. The company noted that load-to-truck ratios represent the number of loads posted for every truck posted on the DAT network of load boards.

Turning to reefers, the national average rate jumped 3 cents to $2.12 per mile. Strong rates outbound from Florida and Southern California, along with challenging weather conditions, contributed to the elevated national average, DAT pointed out.

Available loads for reefers fell 37% over the prior week, while reefer capacity dropped 32%. That caused the load-to-truck ratio to decline 7.4% to 11.3 last week.

As for flatbeds, the national average flatbed rate grabbed 4 cents last week, climbing to $2.15 per mile. Outbound spot rates for flatbed loads from Harrisburg, PA, remained the highest among major markets: up 18 cents to $3.85 per mile—equaling 21.2% over the last month.

Another key flatbed market was Rock Island, IL, where the average rate jumped 29 cents to $3.03 per mile-- and is up 7.6% over the last month. DAT noted that area is home to several major equipment manufacturers.

Nationally, demand for flatbed loads fell 41.9% while capacity dropped 32.9%. That pushed the load-to-truck ratio down 13.4% to 13.5.

“In general, the stronger rates and demand for capacity seem to be driven by an economy running on all cylinders throughout most of the fourth quarter, and especially since mid-November,” DAT senior rate analyst Mark Montague told FleetOwner. “Auto sales and production were particularly strong."

Montague also pointed out that rates and capacity were “also influenced by disruptive winter weather and new Hours-of-Service [HOS] rules, which, combined with the economic uptick, caused spot-shortages of equipment.

“Winter weather had a ripple effect on the supply chain in southern markets like Texas, which are less prepared for it," he added.

Meanwhile, the fourth-quarter 2013 Business Expectations Survey just released by the Transport Capital Partners (TCP) consultancy found that “optimism for volume and rate increases continues to grow, but rates remain flat.”

The survey, prepared by TCP partners Richard Mikes, PhD, and Lana Batts, “sees more carriers getting adequate rates of return, but tight credit and static accessorials [are] continuing issues of concern.

“With a continued lack of rate increases in the trucking industry, some carriers may have hoped to raise income through renegotiating accessorials,” the survey authors pointed out.

“Unfortunately, 42% of carriers surveyed this quarter indicated they do not expect to be able to renegotiate. This is down slightly from the past two quarters.

What’s more, over the last two years, the number of carriers able to up fuel surcharges has fallen from 30% to 11%. And pessimism about accessorials is greater among smaller carriers than larger ones (50% vs. 38%).

“Carriers are more positive when it comes to renegotiating detention times,” according to TCP, with 43% now expecting to renegotiate. While renegotiating detention times does not necessarily raise cash, it can make equipment more productive, the researchers noted.

“Approximately 30% of larger carriers think they will be able to renegotiate miles paid (i.e., move from shortest route to practical route). This change-- were it to materialize--- would have a significant impact on revenues, even with stagnant rates,” observed TCP.

On the other hand, despite the lack of rate increases and static accessorials, Batts and Mikes relate that slightly more than half (54%) of the carriers indicated they are getting an adequate rate of return—marking the highest level yet for this survey.

Still, while positive, the numbers are “not entirely encouraging,” the survey authors continued. “Forty-three percent of carriers still believe they are not getting an adequate return. The issue may lie in how carriers define ‘an adequate rate of return.’

“For the industry to thrive, and not just survive, a large percentage of carriers must be making adequate rates of return to afford the investment in equipment and support services required by modern supply chains,” noted Mikes.

TCP also discerned that carriers are not seeing improvement in credit availability.

Approximately 75% expect credit availability to remain the same – a similar number to one year ago—and so it appears carriers regard tighter requirements for credit as “the new normal.”

“Credit availability and carrier profitability go hand–in-hand, both are essential to replace aging fleet assets and to grow capacity,” pointed out TCP partner Steven Dutro.

“Carriers with stronger profitability and cash flows will find credit available and affordable and will be better positioned to gain market share,” he added.

Editor’s Note: The DAT chart accompanying this news report depicts national average spot market (“broker buy”) rates during the past four weeks. The rates are derived from DAT’s RateView as well as from the company’s network of load boards.