Despite some recently mixed economic indications, especially a weak jobs report for last December, the outlook for freight is actually brightening in the eyes of many analysts.

“We’re actually feeling a little bit better about freight right now,” Eric Starks, president of research firm FTR Transportation Intelligence, told Fleet Owner. “Industrial production is strong and housing starts increased in November. We think the jobs report is an anomaly, mainly weather related. Overall, things are looking better and so may be a sign the economy is gaining better traction.”

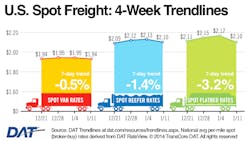

FTR – which holds its next State of Freight webinar February 13 – also noted that the trucking freight spot rate indexes trended up at the end of 2013 and that strength is another indicator, Starks said, that freight demand is climbing.

Indeed, the latest North American Freight Index prepared by DAT – a unit of TransCore – showed that freight activity on the spot truckload markets “recovered nicely” in the firm’s words during the first full week following the holidays.

DAT said the average spot-load volume across all equipment types increased 74% during the week ending Jan. 11, including an 84.9% increase for vans. However, despite higher volumes, the average spot rate across all equipment types fell. Nationally, the average van rate decreased to $1.94 per mile including fuel surcharge, which increased one cent compared to the previous week.After lopsided numbers due to winter weather, the average van rate out of Buffalo NY dropped 31 cents to $2.01 per mile and the Philadelphia PA rate dipped 8 cents to $1.84 per mile, DAT reported. Rates also fell across the West, notably outbound from Los Angeles at $2.08 per mile, a 10-cent drop. Columbus, Ohio, was among the few major Midwestern van markets that saw rates rise, adding 8 cents to an average of $2.13 per mile, the firm said.

Yet pent-up demand came to the fore as weather conditions improved during the week of Jan. 11 as the load-to-truck ratio ion DAT’s load board network increased 46.9% to 5.9, up from 4.0 the prior week, with demand for temperature-controlled units jumping 67.5% last week while refrigerated capacity rose 23.1%.

Demand for flatbeds rebounded in the first full week following the holidays, DAT pointed out, as load availability increased 72.8%. Flatbed capacity, meanwhile, increased 40.2% with the load-to-truck ratio increasing 23.2% to 17.7, up from 14.3 the prior week.

Broader metrics are also reflecting a strengthening economic outlook, despite blips like the December jobs report. The Conference Board, for example, noted that its Employment Trends Index (ETI) increased in December now standing at 115.76, up from 115.72 in November – with the ETI figure for December 5.2% higher than the same month in 2012.

"Despite the disappointing job numbers for December, the improvement in the ETI is signaling solid employment growth in the months ahead," noted Gad Levanon, director of macroeconomic research for the Conference Board. "With the labor force barely growing, partly due to the massive wave of baby boomers retiring, this job growth will continue to rapidly bring down the unemployment rate."

The group also stressed that the gain of only 74,000 new jobs in December stands in contrast to the strengthening posted in other major economic data, suggesting the dip in hiring might prove temporary. For instance, the Conference Board said its Leading Economic Indicators (LEI) metrics and the results from the latest survey of purchasing managers are two economic readings that suggest employment gains will rebound in the New Year.

“With some resolution of the budget battles and the questions about the future course of monetary and fiscal policy, consumers and businesses will feel less need for caution and put some long delayed plans into action in the early months of 2014,” noted Kathy Bostjancic, director of macroeconomic analysis for the group.

“Also, the Conference Board CEO Challenge Survey 2014 and The Conference Board CEO Confidence Index point at greater optimism among business executives,” she added. “Indeed, consumers already started along that path in the fourth quarter, with real consumer spending poised to come in at a much improved 4% annualized growth rate.”

Bostjancic also noted that consumer spending, while selective, is gaining traction. “While the headline increase of only 0.2% in December was on the weak side, the core retail sales were up a firmer 0.7%,” she noted.

“Despite the weather-dampened job advance in December, job growth on average has been solid. Rising household wealth from improving housing and stock markets fed the upscale market,” Bostjancic said. “There might be a falloff in retail sales growth in January, but that has more to do with inclement weather, and will likely be followed by a recovery in February. The resilient American shopper is likely to spend increased wages in the first half of 2014 on replacement furniture and household appliances, even if they are not on sale. And that could be the big economic story for the entire first half of 2014.”

She stressed, though, that low wage growth remains a problem for consumers and that low pricing power remains a big problem for business. “These factors do not preclude an actual pick-up, but only how much pick up in job growth can be expected,” Bostjancic pointed out.

Trucking is feeling the impact of that “low pricing” environment despite the pickup in freight demand. For example, according to DAT’s numbers, the national average reefer rate fell 3 cents (1.4%) during the week of Jan. 11 and lost 4 cents (2.4%) on line haul routes.

After big gains over last few weeks, the average outbound Miami rate dropped 46 cents (18.2%) and Lakeland dropped 4 cents (2.1%) as freezing temperatures hit Florida, DAT reported, with lane rates to Northeastern markets out of Florida also dropped sharply.

Flatbed rates fared little better as the total average rate for flatbeds fell 7 cents (3.2%) to $2.10 per mile last week, according to DAT’s data.

Yet other positive developments are occurring where freight movements are concerned, especially is the narrowing of the U.S. trade gap, which is signaling stronger demand for U.S.-made goods, said Lindsey Piegza, Sterne Agee’s chief economist.

“The U.S. trade gap narrowed to a three-year low thanks to a continued decline in oil imports and a boost in exports,” she noted. “The gap narrowed 12.9% from negative $39.3 billion to negative $34.3 billion in November, the lowest since October 2009. Bottom line: Improving economies abroad are strengthening demand for U.S. made goods and helping to boost the U.S. manufacturing base along the way.”

Meanwhile, Piegza stressed that continued development and production of domestic energy is helping to wean America off its dependency on foreign oil and gravely improve the trade balance picture. “Since 2011 American petroleum imports have already declined 30%,” she said.

Domestically, U.S. factories are benefitting from a continued robust appetite for autos, while a positive and improving housing market is supporting demand for building materials, Piegza noted.

“Going forward, positive expectations for growth overseas will further bolster U.S. orders in the new year,” she pointed out. “Of course we will need to see those expectations of strength come to fruition first.”

About the Author

Sean Kilcarr

Editor in Chief

Sean Kilcarr is a former longtime FleetOwner senior editor who wrote for the publication from 2000 to 2018. He served as editor-in-chief from 2017 to 2018.