DAT Freight Index: Spot market demand increases for sixth straight month

E-commerce and grocery items were major sources of December freight for what is usually a quiet period on the spot market.

Van rates, volumes increase

“Van rates and volumes shot up in places like Memphis and Columbus, both associated with e-commerce fulfillment, and even Denver and Seattle exhibited unusually robust rates and shipping patterns,” said Mark Montague, DAT industry analyst.

Van freight availability increased 10% compared to November and surged 52% year over year, for an average van load-to-truck ratio of 3.8, a 22% increase compared to November and 80 % higher year over year. The load-to-truck ratio measures the number of available loads for each truck posted on the DAT Network of load boards, and a change in the ratio often signals impending changes in rates.

The national average spot truckload rate for vans was $1.73 per mile including a fuel surcharge. The average rate was the highest for the year, up 7 cents month over month and 1 cent compared to December 2015.

Reefer freight availability highest in 21 months

Reefer freight availability increased 10% in December compared to November, primarily due to demand for fresh and frozen foods at Christmas. The reefer load-to-truck ratio of 8.2 was the highest monthly ratio in the past 21 months. Compared to December 2015, reefer volume was up 55% in December.

The national average spot market rate was $1.98 per mile for reefers, up 2 cents from November to December and equal to the June peak season average. Compared to December 2015, the average rate was 2 cents per mile higher.

Demand for flatbed trucks increased 2.3% compared to November and 48% compared to December 2015. Flatbed rates increased 5 cents compared to November, to $1.95 per mile. That national average was up 1 cent compared to December 2015.

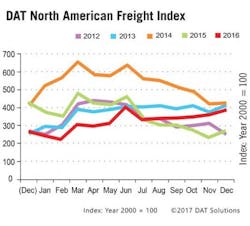

Strong second half makes up for weak start

Despite a strong second half of 2016, spot market freight volume for the entire year fell 7.7% compared to 2015.

“While overall demand for truckload capacity grew 23% in the second half of 2016, those gains were more than offset by a 29% decline during the first half,” Montague said.